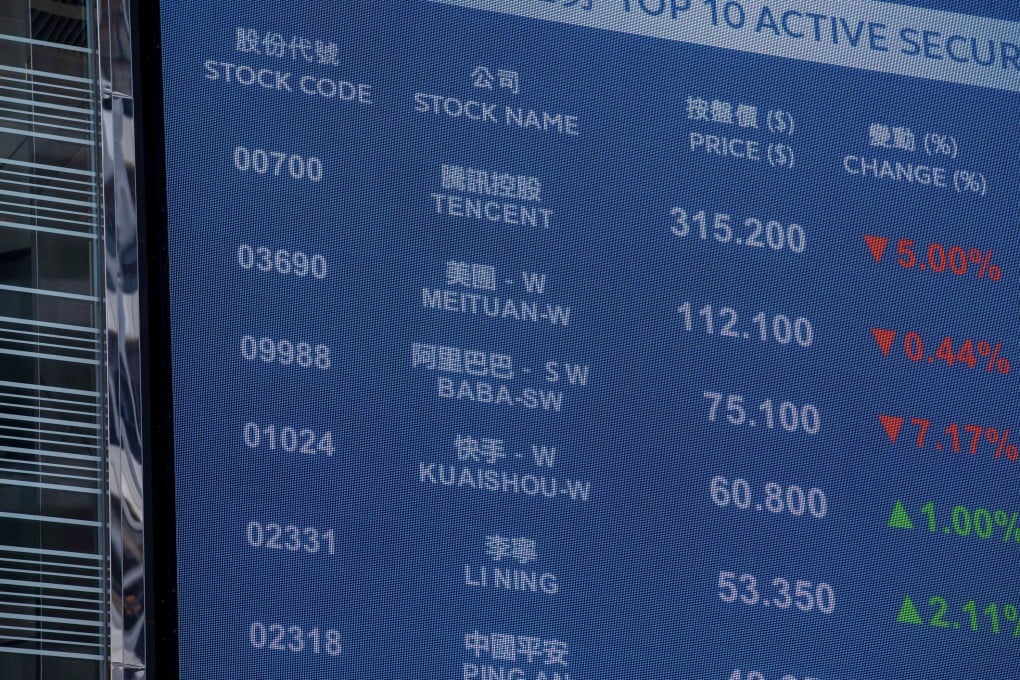

Chinese tech stocks at rock bottom get buyback seal of approval after Goldman predicts upside

- Investors may see a series of stock buybacks after China’s CSRC calls for measures to stem market rout

- Xiaomi joins the fray after Alibaba tops up its buyback programme to a record US$25 billion amid a stock plunge

Smartphone maker Xiaomi Corp is the latest to join the fray by announcing a HK$10 billion (US$1.28 billion) programme, giving its shares a pop. Not a bad move to emulate, after Alibaba Group Holding’s 11 per cent rally on the back of its record US$25 billion plan.

“That would be a signal that stocks have bottomed out,” said Wang Zheng, chief investment officer at Jingxi Investment Management in Shanghai. “Stock prices have reflected all the headwinds and investments are worthwhile now.”

China’s biggest companies, which dominate the Hong Kong stock market, are sitting on a giant pile of cash. The 66 members of the Hang Seng Index had US$2.4 trillion of cash on their balance sheets in their latest financial reports, according to Bloomberg data, a 23 per cent jump from two years earlier.