Advertisement

China tech crackdown: after a trillion-dollar rout, has the stock market drubbing gone too far?

- China’s internet companies have lost an estimated US$1 trillion in value in the past 14 months

- Most Chinese tech giants are now trading close to historic lows

Reading Time:5 minutes

Why you can trust SCMP

69

This year will go down as a tough period for Chinese technology firms, as Beijing moved to exert control over the once-freewheeling sector. In the last of a four-part series, the South China Morning Post looks at the market fallout, the cost to investors, and the struggle to determine the end game. The first part is here, the second part here, and the third part here.

Advertisement

On the evening of November 3 last year, soon after China’s prime-time news broadcast ended, a short statement emerged from the Shanghai Stock Exchange, setting in motion a US$1 trillion rout in the offshore Chinese stocks, one that is still wiping out value more than a year on.

The exchange halted Ant Group’s US$39.7 billion dual listing in Shanghai and Hong Kong, 48 hours before shares were due to begin trading. It also kicked off a year-long clampdown on China’s internet-related industry, with various regulators from antitrust rules to taxation putting in stops to cool the feverish growth of the country’s internet giants.

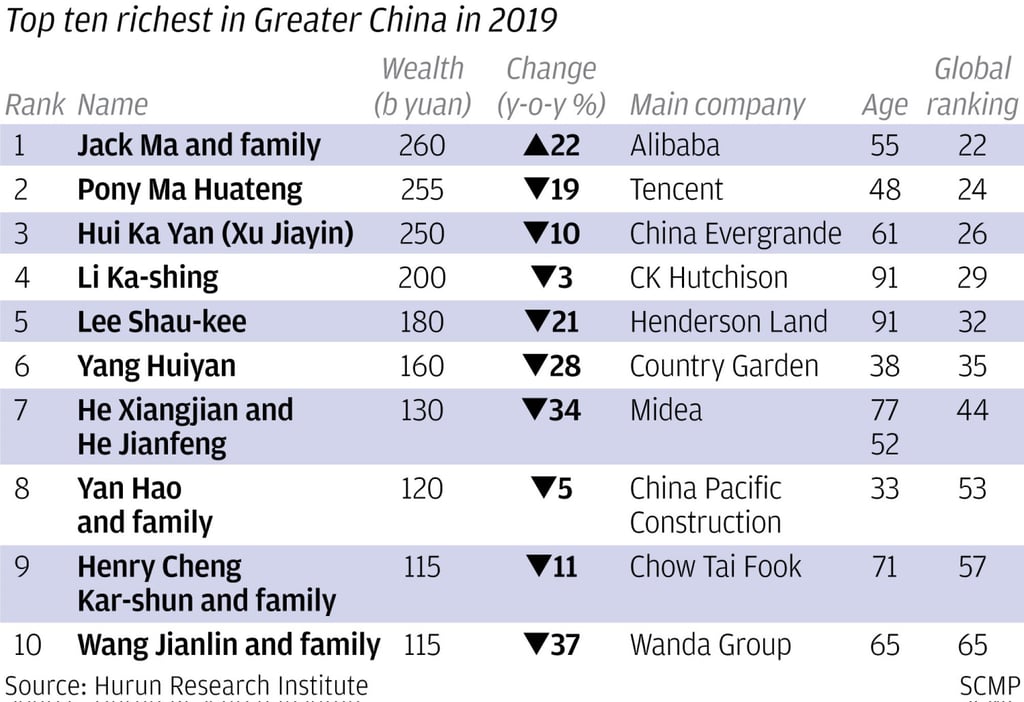

The tumultuous year in China technology has not only wiped out billions and decimated the fortunes of some of the world’s richest entrepreneurs, it also fundamentally upended how some of the most promising start-ups are appraised. Assumptions of unfettered and symbiotic growth, often based on data collected from captive users in so-called internet walled gardens, can no longer be taken for granted.

“What China does in terms of tech regulations echoes similar concerns coming from other countries including the US,” said Wang Lei, a US-based portfolio manager at Thornburg Investment Management that manages US$49 billion of assets. “The way China deals with it is more straightforward and too abrupt for the capital market to digest in a short period of time.”

Has the crackdown gone too far?

Advertisement

Advertisement