Chart Book | Chart of the day: Harsh truth looms for China tech stocks

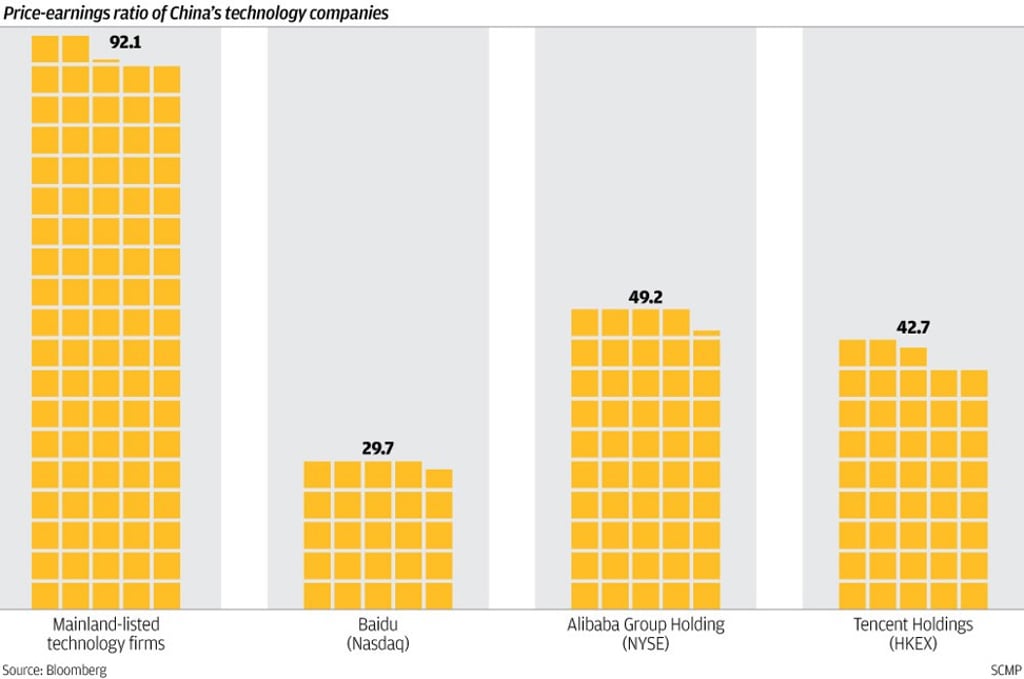

Chinese-listed technology companies are likely to suffer a blow from policymakers’ recent move to lure their overseas-traded peers back for a domestic listing. Based on their reported price-earnings ratio, the 470 technology firms on the Shanghai and Shenzhen exchanges were at least 87 per cent more expensive than the overseas-listed trio of industry giants Baidu, Alibaba Group Holding and Tencent Holdings, Bloomberg data showed. JD.com trades at 51.8 times estimated earnings for this year as the United States-listed online retailer is expected to return to profit in 2018. Alibaba, which owns the South China Morning Post, and JD.com are likely to be among the first to list at home by selling Chinese depositary receipts, according to Sinolink Securities. With these industry majors about to trade domestically, the valuation of the technology sector could be further crushed as investors focused more on earnings growth and fundamentals, said Ken Chen, a strategist at KGI Securities.