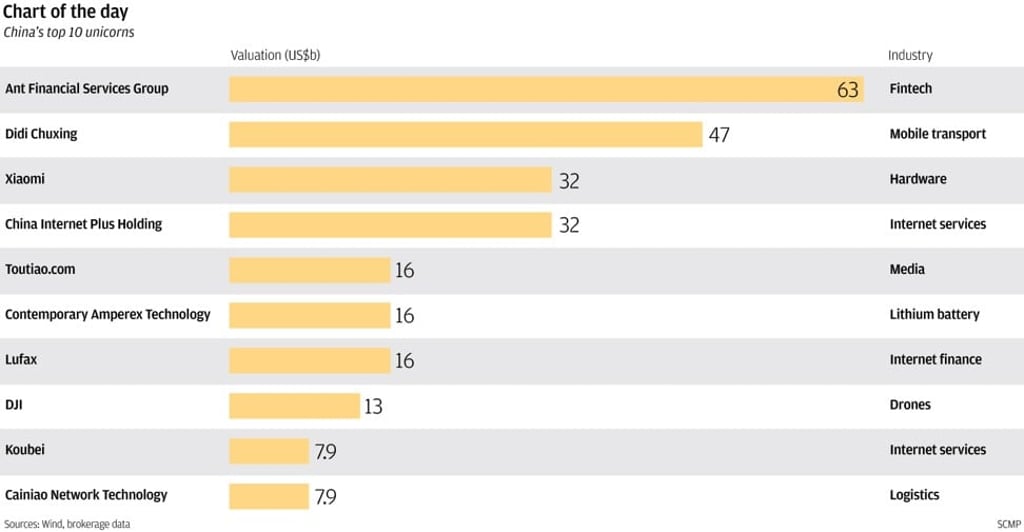

Chart Book | Chart of the day: Start-ups leading the unicorn league in China

The market value of China’s US$7.8 trillion stock market is likely to grow 6 per cent if policymakers succeed in wooing the country’s unicorns, or start-ups valued at more than US$1 billion, to list their shares on the domestic bourses. The world’s second-largest economy is home to an estimated 120 of these companies with a combined valuation of 3 trillion yuan (US$473 billion), according to brokerage data. Ant Financial Services Group, backed by Alibaba Group Holding, which owns the South China Morning Post, is ranked top, followed by Didi Chuxing and Xiaomi. China’s stringent listing rules on profitability track record have prompted the likes of Alibaba, Tencent Holdings and Baidu to seek listings in either the United States or Hong Kong. In view of the country’s fast-growing technology industries, regulators are now ready to ease the regulations. This month, the Shenzhen Stock Exchange said a major revision would be held for the listing rules this year to clear the hurdles facing share sales by new economy companies.