Opinion | After such a blockbuster year, can Asian stocks do it again in 2018?

Corporate earnings are on the rise, potentially powering another good year for Asian equities, even as 2017 winds down as one of the best performing in the past 30 years

A modest pullback over at the tail end of the year should not obscure the fact that global equities in general and Asian equities in particular delivered an outstanding performance in 2017. According to the MSCI family of indexes, as of mid-December 2017, the US had posted returns of around 19 per cent, Latin America 16 per cent, Eastern Europe 11 per cent, and Europe 8 per cent.

Conversely, the MSCI Asia ex-Japan Index (MXASJ) posted a mighty 35 per cent rally during the year, making an all-time high in November and in so doing, taking out the previous record high posted in the heady pre-Lehman Brothers days of December 2007.

It is entirely likely the Index will continue to post fresh highs into the first quarter of 2018 in much the way developed market benchmarks did throughout 2017. However, I think it’s entirely unlikely that the Index in 2018 will record anything like the performance recorded in 2017. Indeed, there’s only been five years in the last 30 years – in 2009, 2007, 2003, 1999 and 1993 – when the MXASJ did better.

But 2017’s performance is yesterday’s story; and rightly, investors will be seeking to forecast and position for expected returns in 2018. In fact, I anticipate the MXASJ will deliver total returns (including dividends) of around 15 per cent next year driven by a potent cocktail of robust fundamentals, resurgent earnings, and further multiple expansion. I would caution, however, that such gains are unlikely to come in a “straight line”, as markets become overbought, inevitably, temporary correction events will ensue.

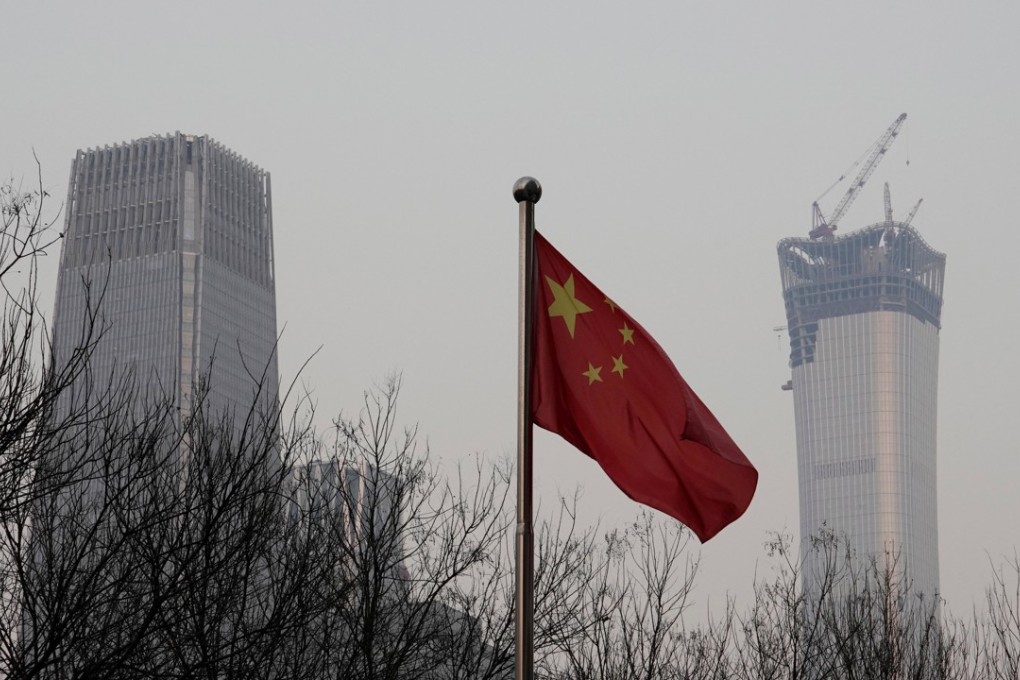

At the regional level, we forecast the Asia region’s GDP will expand by 5.9 per cent – roughly flat to last year. But more important to the performance of Asia’s equity, increasingly, is China’s near-term growth trajectory; and in that respect there is increasing optimism. In 2010 to 2015, as China’s growth decelerated, earnings remained broadly flat across the region. But China’s subsequent economic stabilisation has done much to lift earnings expectations across the region.

In 2018 we expect China’s economy will expand 6.5 per cent, down slightly on the 6.8 per cent expected in 2017. In other words, the broad-based growth drivers in China that super-charged markets across the region are expected to maintain a similar momentum, lending a similar degree of support.