HKEX cap on independent directors’ tenure sparks debate amid economic turmoil

Bourse operator faces resistance to capping INEDs’ number and tenure, with critics arguing the timing was wrong and the focus should be on survival

Bourse operator Hong Kong Exchanges and Clearing (HKEX) faces a challenge in implementing its proposal to cap the number and tenure of independent non-executive directors (INEDs), amid differing stances from directors, companies and institutional investors.

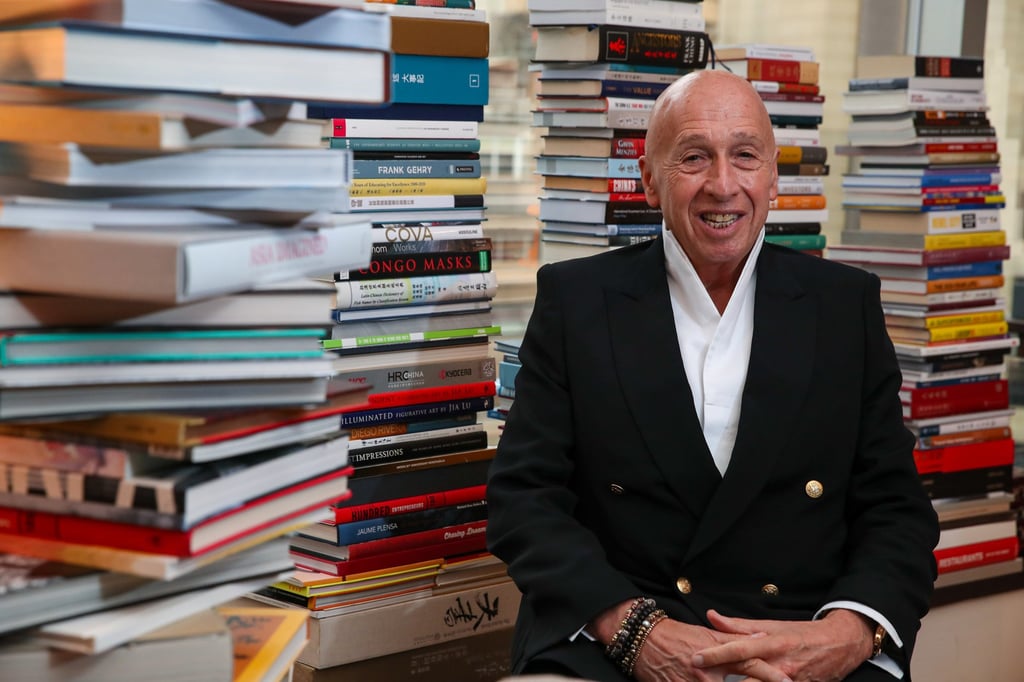

“The timing is wrong to make any changes to the rules for independent non-executive directors now,” said Allan Zeman, the founder and chairman of Lan Kwai Fong Holdings, who serves as an INED for six companies.

“The current economic environment is the worst in more than half a century that I have been here in Hong Kong,” Zeman, who has turned the Lan Kwai Fong area in Central into Hong Kong’s iconic nightlife district, said in an exclusive interview with the Post.

With the number of company bankruptcies hitting a record high, the focus should be on survival and moving their businesses forward, the tycoon said, adding that companies should not be forced to change their independent directors and bring in new members on board.

In June, HKEX suggested a range of proposals to improve corporate governance, including banning an INED from sitting on more than six boards for a maximum of nine years on each board. Newly listed companies have to follow the rule from January 2025, while existing firms have been given three years to rectify the “overboarding” problems.