Electric cars may get the chance of a lifetime to replace petrol guzzlers faster as they emerge unscathed in chips shortage

- Global output of petrol-guzzlers may shrink by up to 700,000 vehicles in the first quarter, or 4 per cent of worldwide production, IHS Market said

- Ford slashed its first-quarter roll-out including the bestselling F-150 truck by 20 per cent, while General Motors said extended down time in Kansas, Canada and Mexico until mid-March will erode its 2021 bottom line by between US$1.5 billion and US$2 billion

The worldwide shortage in semiconductor chips has wreaked havoc on the global automotive industry, with car makers from Ford Motor to Volkswagen forced to scale back production, but the crisis is proving an opportunity for one small segment of the industry: China’s electric vehicle makers.

Global output of petrol-guzzlers may shrink by up to 700,000 vehicles in the first quarter, about 4 per cent of worldwide production, according to a forecast by IHS Market. Ford slashed its first-quarter roll-out including the bestselling F-150 truck by 20 per cent, while General Motors said extended down time in Kansas, Canada and Mexico until mid-March will erode its 2021 bottom line by between US$1.5 billion and US$2 billion.

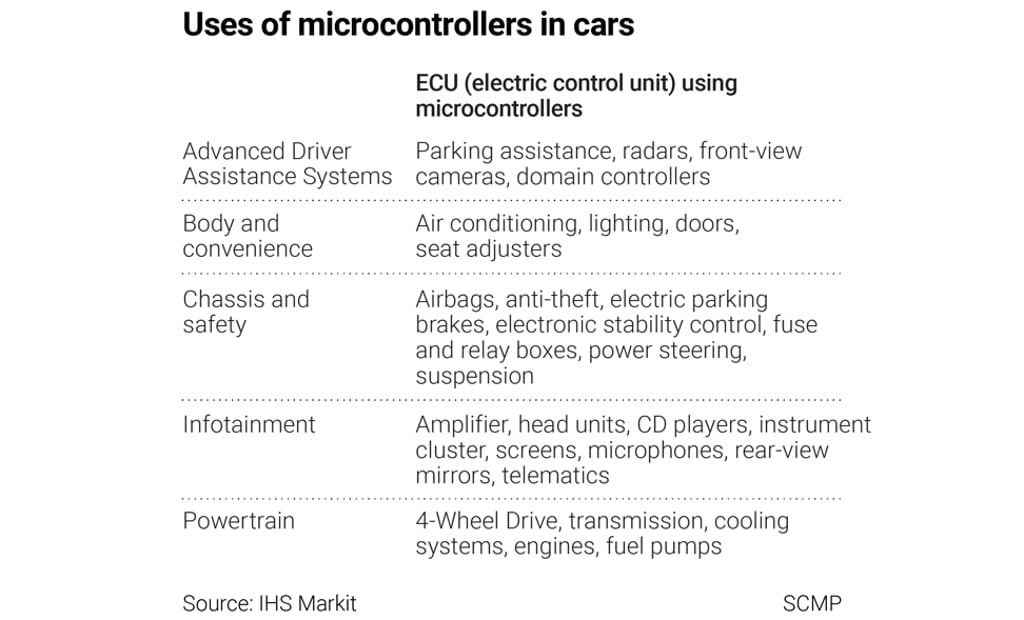

Amid the crisis, electric car makers have emerged mostly unscathed, largely because of their smaller production volumes and reliance on higher-end chips like AI processors, used for complex data processing tasks, that can cost US$100 apiece. Traditional car makers consume high volumes of microcontrollers for engine control, currently in short supply despite their US$1 price tags.

Artificial intelligence (AI) chips “are much more expensive and important for smart EV makers,” said Wang Junkang, a design engineer with Li Auto, one of China’s three New York-listed NEV start-ups. “The leading smart NEV start-ups are not competing against ICEs to secure supply of the AI chips.”

Producers of ICEs are pinning the blame on a 2020 miscalculation over the pace of recovery in demand for big-ticket items such as automobiles during the Covid-19 pandemic, which drove foundries to shift to making higher-value chips for game consoles and gadgets, said ST Microelectronics’ engineer Qiao Mu.