Advertisement

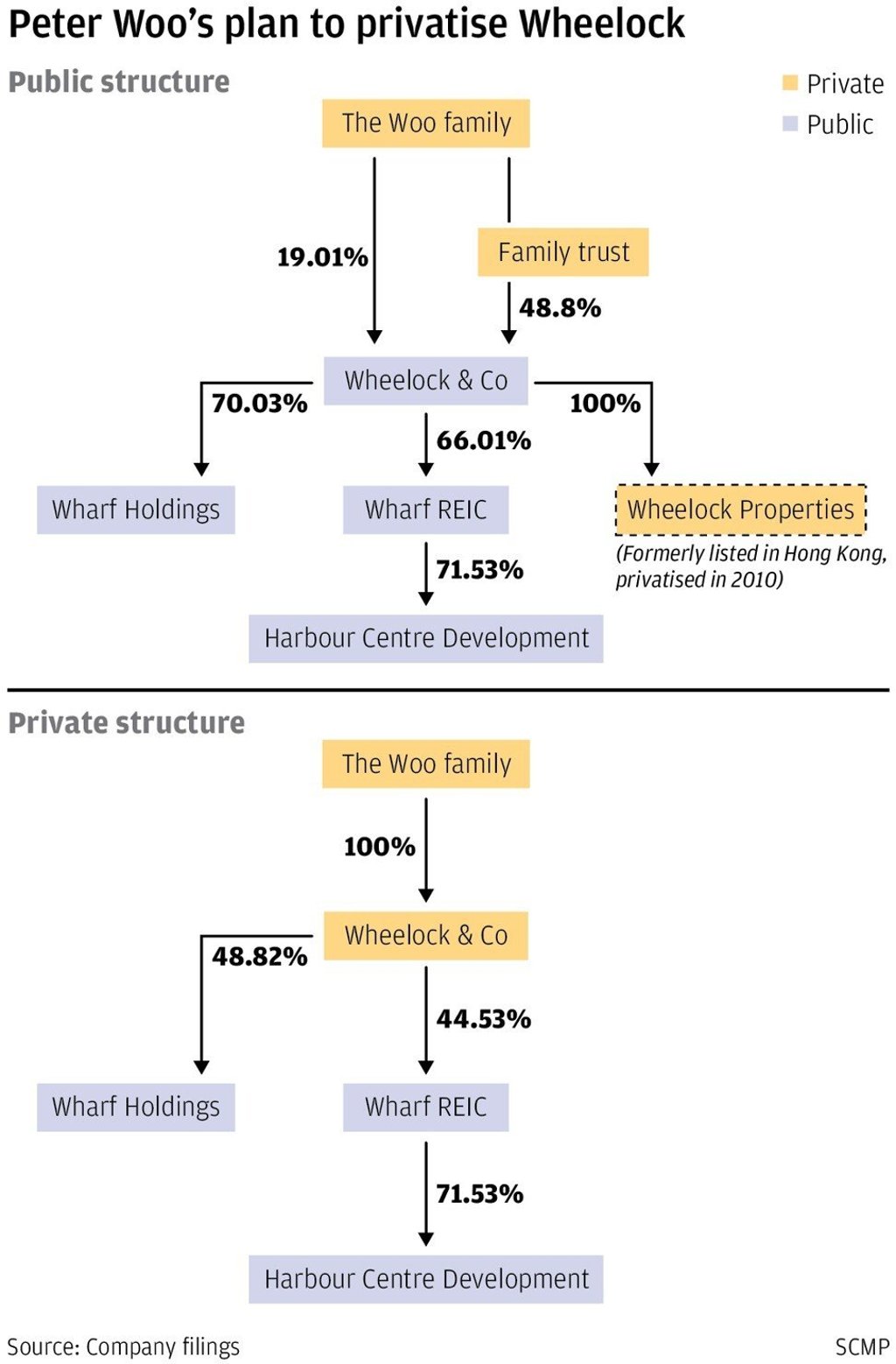

Wheelock ends 57-year history as public company as shareholders approve HK$126 billion privatisation plan

- Billionaire Peter Woo’s privatisation plan is approved by 99.87 per cent of shareholders at a vote on Tuesday

- The stock’s last day of trading on the Hong Kong exchange is on June 18, company says

Reading Time:3 minutes

Why you can trust SCMP

Wheelock and Company, Hong Kong’s fourth-largest developer by market value, will bring the curtains down on its 57-year presence on the Hong Kong stock exchange this week, after shareholders agreed to a privatisation plan amid a stock slump.

Advertisement

More than 99 per cent of Wheelock’s shareholders consented to the plan at a meeting on Tuesday, the company said in an exchange filing. The stock will trade for the last time on June 18, it added.

Wheelock’s HK$126 billion (US$16 billion) proposal is one of handful of take-private deals totalling at least US$8.76 billion to have gained traction since early this year, according to Refinitiv data and stock exchange filings.

Wheelock, controlled by billionaire Peter Woo Kwong-ching, has been rangebound over the past three years. The stock has declined by about a quarter from a high in March 2017 by the time the take-private deal was announced. The company cited its low stock price relative to its asset backing among the reasons for the privatisation.

Advertisement

Chairman Douglas Woo Chun-kuen, the son of Peter Woo, thanked shareholders for their support in front of dozens of investors who convened to vote for the deal on Tuesday at a hotel ballroom in Tsim Sha Tsui.

Advertisement