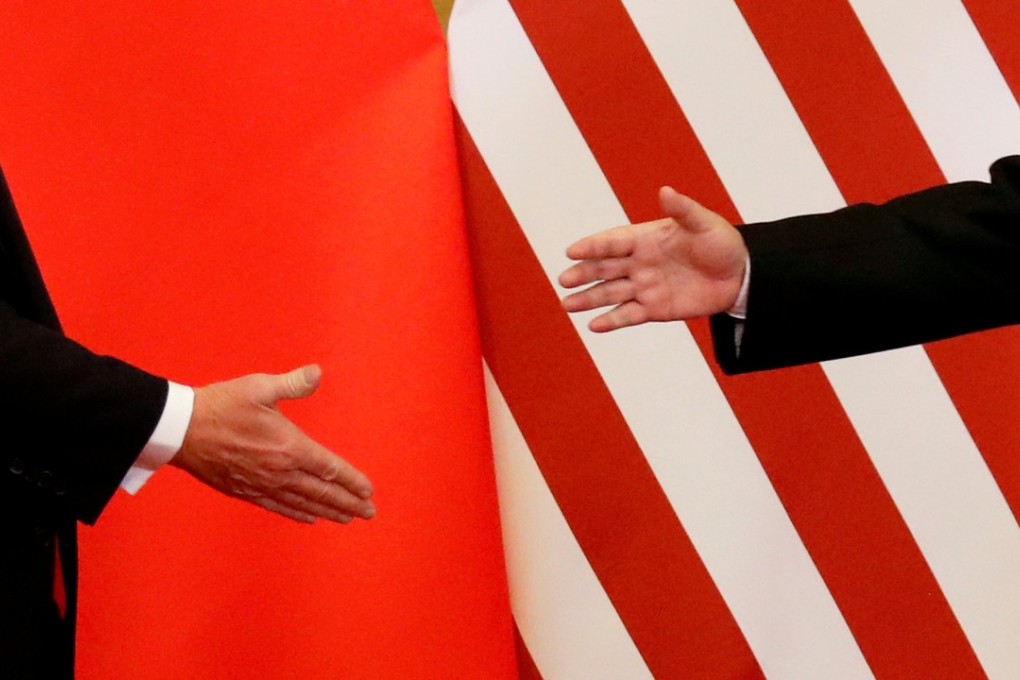

Trade war shrinks Chinese companies’ first-half mergers and acquisitions in America

Deals in the US have fallen to US$1.5b in the first half from US$7.5b a year ago, bumping the US down to China’s eighth top target market

China’s outbound mergers and acquisitions to the US in the first six months of the year shrank on heightened trade tensions with the US even as the mainland’s overall outbound deals grew and swung more towards Europe.

The total Chinese outbound M&As have increased since the beginning of last year, but deals in the US have shrunk as the dispute escalated between US President Donald Trump and his Chinese counterpart Xi Jinping over duties and security on investments, culminating to this month’s trade war and retaliatory battle of tariffs.

Total value of these global outbound M&As reached US$76 billion in the first half of the year, up from US$53 billion in the year-earlier period, according to data compiled by Thomson Reuters for multinational law firm Baker McKenzie.

But the value of US company buyouts, or 44 deals, fell to US$1.5 billion during the first half of 2017, from US$7.5 billion, bumping the US down to China’s eighth top target market from No 2 in early 2017. UK was China’s top market with US$15.23 billion at the time.

Purchased US assets fell to US$3.7 billion in the second half of 2017, with 62 deals making up 5 per cent of global outbound value, lowering the US to the fourth top target country.

“The escalating trade tensions between China and the US is certainly a major factor,” said Tracy Wut, M&A partner at Baker McKenzie, Hong Kong. “The other would be the increasing scrutiny of the CFIUS [Committee on Foreign Investment in the US] review, which has raised a lot of uncertainties around deal certainty and timetable.”