China is considering an ‘insurance connect’ that would lower barriers to Hong Kong insurers, enable local offices to process claims

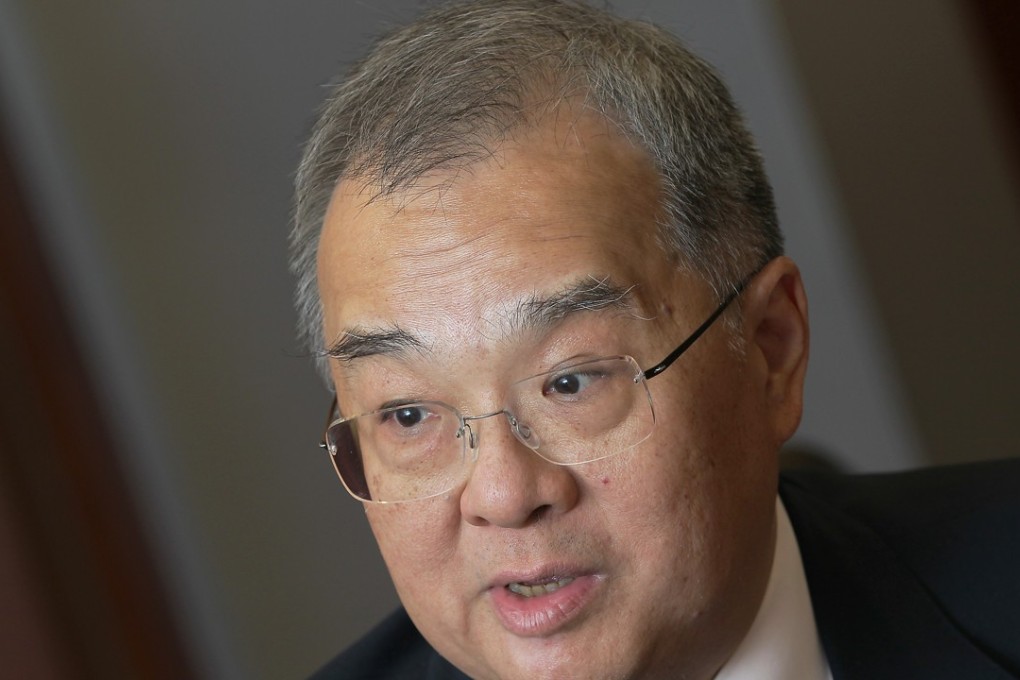

Hong Kong authorities are working with their mainland counterparts to establish a special channel for the marketing, sale and processing of insurance products, using a model pioneered in the Stock Connect, according to Insurance Authority chairman Moses Cheng Mo-chi.

Cheng said he and Insurance Authority chief executive John Leung Chi-yan proposed the idea to the mainland’s banking and insurance regulator China Banking Insurance Regulatory Commission (CBIRC) during a meeting in May and received “better than expected positive feedback”.

Further discussions with mainland officials are planned for Hong Kong, he said.

He said the idea for the special channel originated with local Hong Kong insurance companies.

“If the experience is good, it could then be expanded into a full scale insurance connect scheme to allow mainlanders to buy policies from Hong Kong companies in the mainland while Hongkongers can also buy products from mainland insurers,” he said.