Hong Kong insurers thumped by 37pc plummet in life premiums paid by mainlanders

‘We will need to wait and see if Beijing relaxes its controls or offers any special incentives for the Greater Bay Area, whether there is another wave of mainlanders buying life products here,’ says sector lawmaker Chan Kin-por

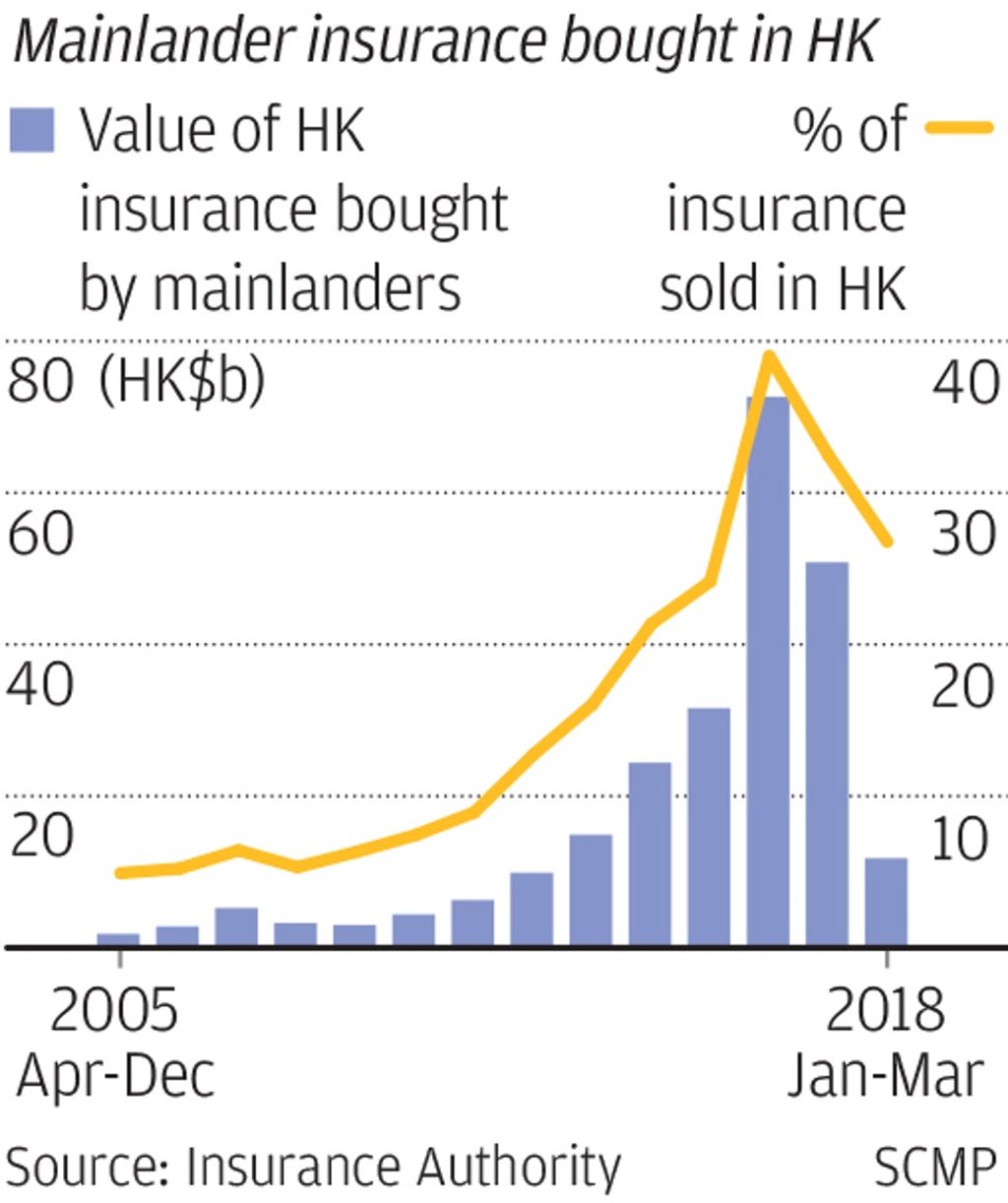

There has been a record first-quarter fall in premiums spent by mainlanders on life insurance policies in Hong Kong, after Beijing imposed tighter curbs on capital outflows to clamp down on overseas buying.

Mainland buyers spent HK$11.8 billion (US$1.5 billion) on life premiums in first three months of 2018, 37 per cent down from HK$18.8 billion in the same period last year, and less than half of the peak spending of HK$23.7 billion recorded in the fourth quarter of 2016, according to latest data from the Insurance Authority.

A massive 95 per cent of their spending was on protective and medical products during the quarter, while the remainder was on investment-linked products.

“Beijing imposed a number of control measures on mainlanders buying life products in Hong Kong last year and this has led to the fall – but the decline should have already stabilised,” said Chan Kin-por, the lawmaker representing the insurance sector in Hong Kong.