Why Hong Kong’s banks are targeting growth again after years of cost-cutting

Rising interest rates and potential cost savings from technology offer opportunities for increased revenues

His statement exemplifies a sudden change of tack among Hong Kong’s big lenders after years of focusing on cost-cutting and balance sheet reduction.

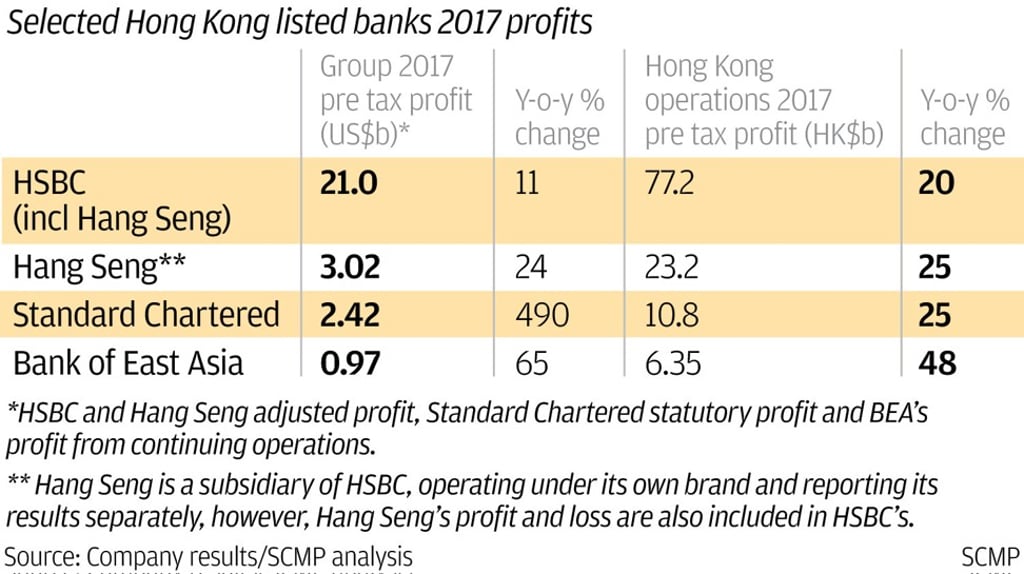

Standard Chartered was one of four major Hong Kong high street banks to report their full-year profits in the last two weeks, and whose management has finally started to talk about growth again, along with across-the-board increases in their earnings.

In November 2015, Standard Chartered launched a three-year plan to remove US$2.9 billion of costs from its business as it reported a loss for the third quarter thanks to ill-judged expansion. The bank said in its 2017 results that it had realised 85 per cent of those savings.