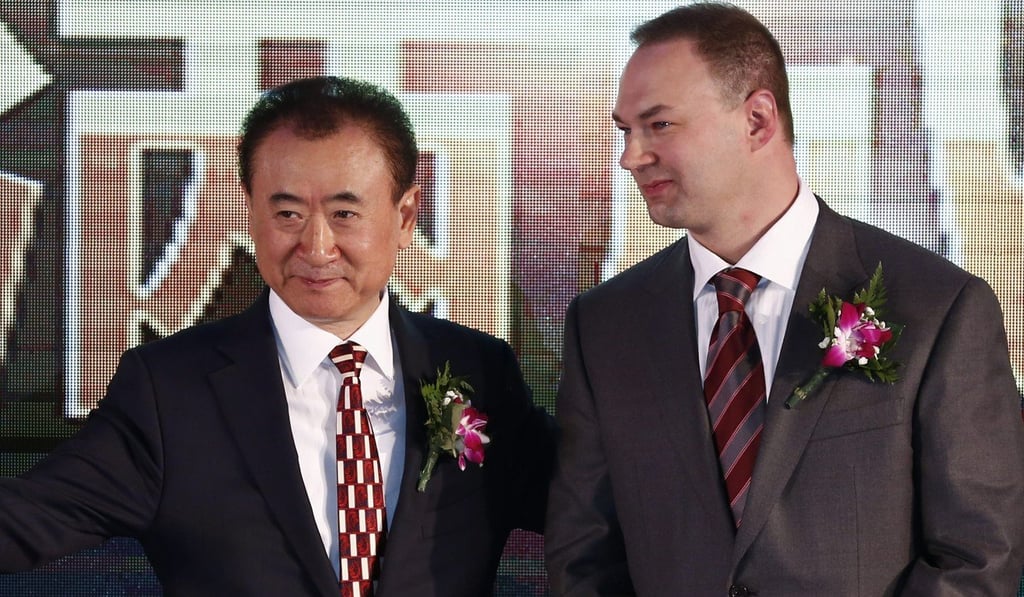

The View | Has Wanda made a Legendary mistake with its acquisition of the Hollywood studio? Only time will tell

The Chinese conglomerate has a seemingly uphill task of integrating the US$3.5 billion purchase of Legendary Entertainment with its portfolio of shopping malls and cinemas as it undergoes restructuring

In Hollywood’s and China’s reluctant on and off again relationship, the predominant problem is determining the substance of the relationship. What are Chinese firms actually buying and how is it actually valued?

Perhaps the source of reluctance for Beijing regulators occurred when they read the notorious account of Sony’s troubled 1989 acquisition of Columbia – Hit and Run: How Jon Peters and Peter Guber Took Sony for a Ride in Hollywood, by Nancy Griffin and Kim Masters. Guber presciently distilled “the perception of power” in Hollywood, where the only underlying purpose is extracting money. Everyone except Sony made money along the way.

The first transaction was Sony’s US$4.7 billion acquisition of Columbia Pictures Entertainment, which included TriStar. Then, the US$200 million buyout of Guber-Peters Entertainment to hire the two partners. Finally, Sony spent more than a billion dollars to buy out Guber’s and Peters’ deals with Warner so they could run Sony. Within five years Sony declared a loss of an additional US$3.2 billion.

Defining and understanding financial value of what comprises a Hollywood studio is as difficult as making a successful film. Yet, with so many types of mainland enterprises from mining, internet to real estate, trying to buy their way into Hollywood, their stockholders and government overseers should be wondering what they are really buying when they say they are acquiring a studio.

The lines among a film financing vehicle, a creator of intellectual property or a film distributor are distinct.