Advertisement

Dirty fighting in some of Hong Kong’s wealthiest families may undo value of kinship

Reading Time:4 minutes

Why you can trust SCMP

Family-owned businesses, when they are well-managed and cohesive, can outperform other types of corporate structure, according to a 2015 Credit Suisse report, which studied 920 family-controlled enterprises with at least US$1 billion in market value.

Advertisement

Their average annual revenue grew 10 per cent from 1995 to 2015, better than the 7.3 per cent increase among members of the MSCI Index in the same period.

“Family businesses appear to demonstrate superior cash returns and economic value creation, underpinning premium valuations and share price performance,” the bank said.

Hong Kong had the fifth-largest representation in Credit Suisse’s study, after the United States, mainland China, India and Switzerland.

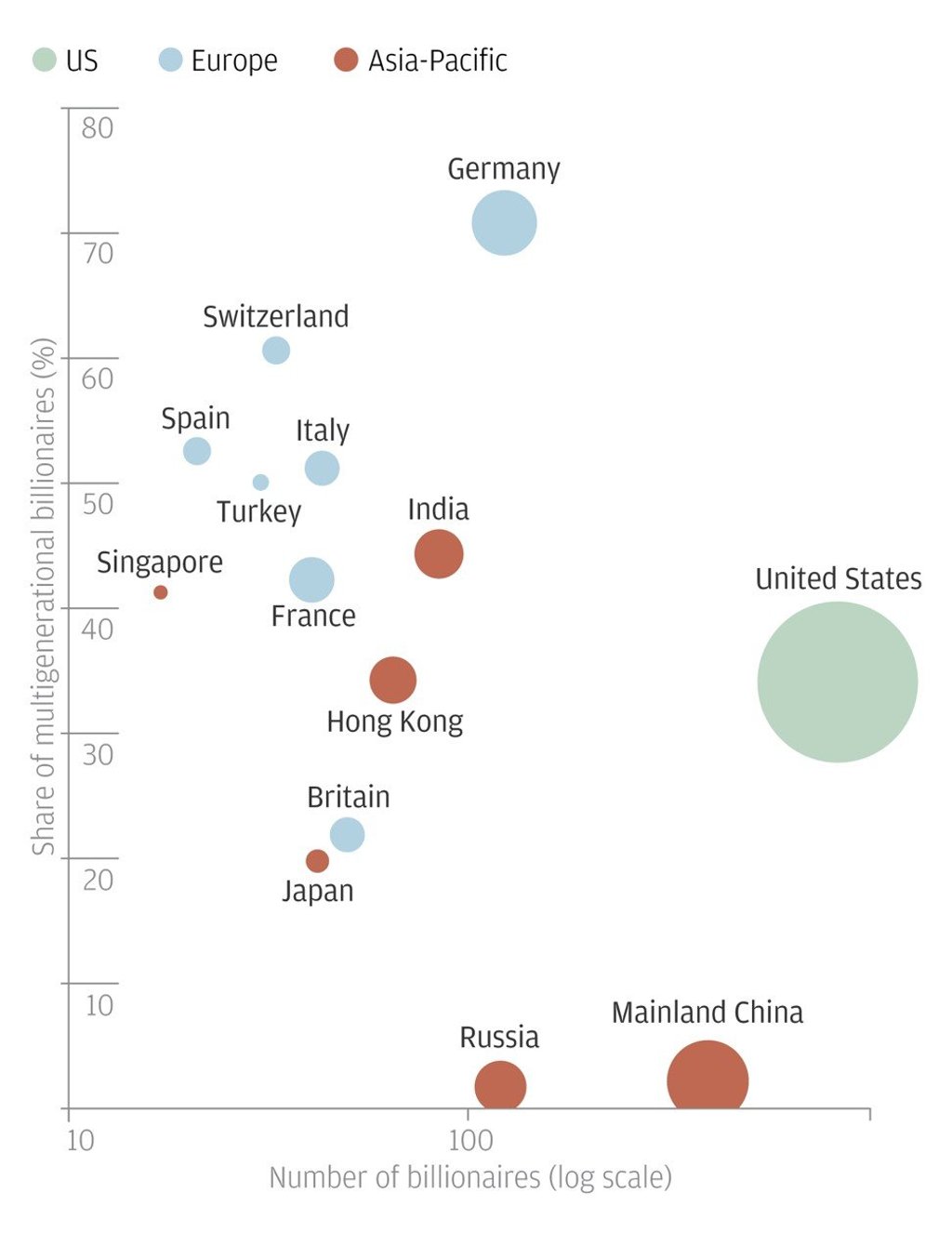

While German and Swiss billionaires were the most adept at handing their wealth to their successors, Hong Kong ranked ninth out of 14 geographies in a UBS study, behind Singapore and India.

Advertisement

Advertisement