New | Hong Kong, mainland China shares finish higher as Asia responds well to Fed rate rise

HSBC, China Construction Bank and ICBC among most heavily traded stocks

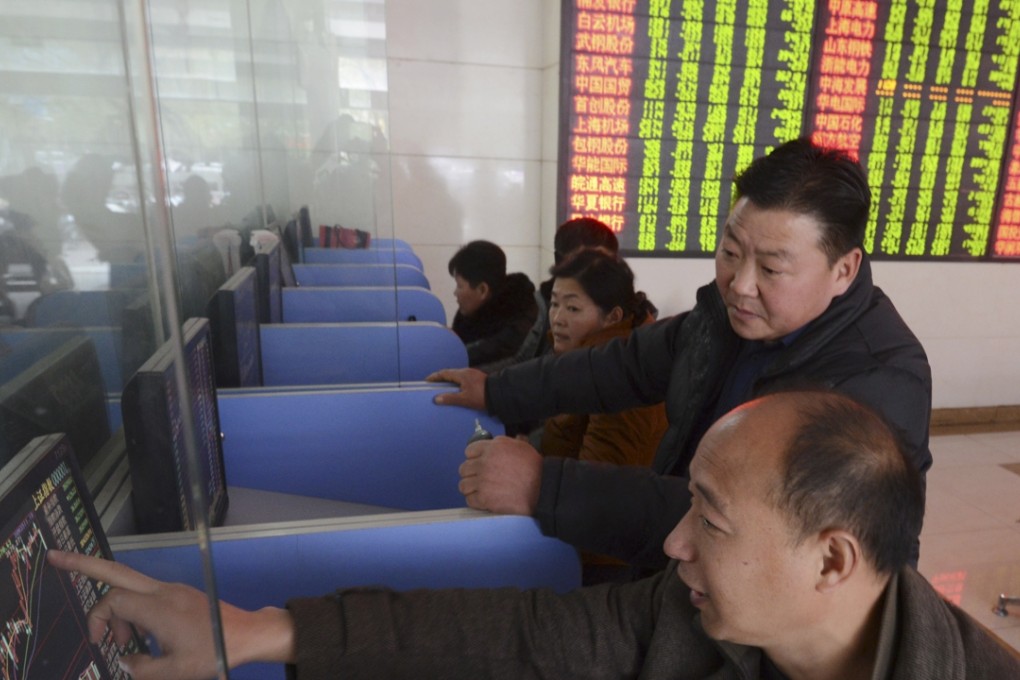

Stocks across Asia leapt on Thursday following the US Federal Reserve’s decision to raise interest rates, while mainland Chinese stocks soared to three-week highs.

United States interest rates will rise by 25 basis points for the first time in nearly a decade, the Fed announced on Wednesday, signalling an end to America’s near-zero rate regime.

The Hang Seng Index rose rapidly in the morning following the news, before slowly falling to finish up 0.79 per cent at a week high of 21,872.06. The H-Share index rose 1.34 per cent to 9,666.52.

Financials drove the share market in Hong Kong on Thursday, with HSBC, China Construction Bank and Industrial and Commercial Bank of China among the most heavily traded stocks.

HSBC shares surged by 2.83 per cent, rising to HK$61.80, while AIA rose by 1.40 per cent to finish at HK$47.10.

Ample Capital asset management director Alex Wong said the Hong Kong market had risen substantially on Wednesday in anticipation of the cut. But he said the local market had been held back by a drop in commodities on the back of a stronger US dollar.

“You are seeing a pull back in resources stocks like PetroChina ... so this rate rise actually created a polarising effect in Hong Kong because we are seeing a pullback in resources but an uplift in banking,” Wong said.