Fortune Reit eyes acquisitions of shopping malls

Trust upbeat on sales as it seeks to benefit from low interest rates and declining gearing ratio

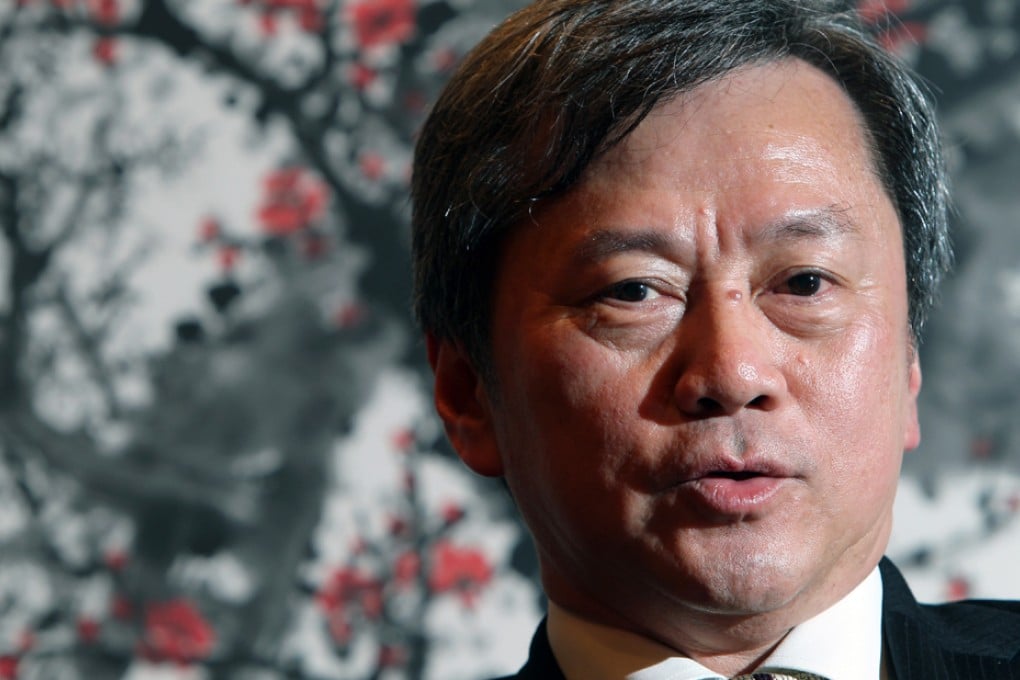

Fortune Real Estate Investment Trust is looking to acquire shopping malls while its gearing and interest rates remain low, the reit's manager said yesterday.

Despite concern that the United States will soon scale back its loose-money policy, which has affected the return of products such as bonds and trusts, Chiu said the Federal Reserve would not retreat from buying bonds before next year, based on remarks by Fed chairman Ben Bernanke.

His comment came as the reit, which has 16 retail properties in private housing estates in Hong Kong, announced net property income jumped 14.5 per cent year on year to a record HK$437.6 million on revenue that rose 13.4 per cent to HK$609.2 million, also a record.

Distributable income amounted to HK$307 million in the first half of this year, up 14.4 per cent from HK$268.3 million a year earlier. Distribution per unit was 18 HK cents, 13.8 per cent more than a year ago, for an annualised distribution yield of 5.1 per cent.

Chiu said the reit is planning to renovate its malls and make changes to the tenant mix. He said rents increased about 18.2 per cent when the reit renewed contracts with its tenants in the first half of the year.