Opinion | Dairy duo must show that someone is not milking the deal

First came the fund-raising, then the dividend payouts, and now the takeover offer from Mengniu. Yashili's about-turn needs to be explained

China Mengniu Dairy's planned takeover of baby formula milk producer Yashili International is an important case to study. It is not about the consolidation of the country's dairy industry but our regulatory regime.

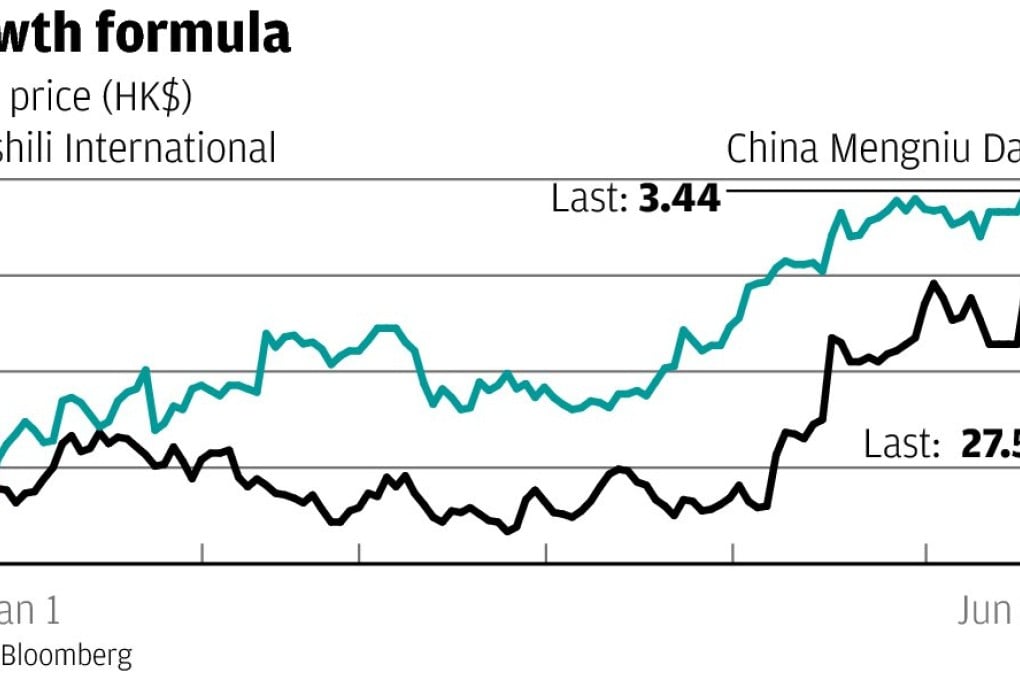

On Tuesday, Mengniu said it would buy all the shares of Yashili at HK$3.50 each, 9.4 per cent above the latter's last closing price. That priced Yashili at HK$12.4 billion.

The deal shed new light on a surprising and puzzling decision by the Yashili board on May 3 to pay a special dividend of one billion yuan (HK$1.2 billion).

It is surprising because that's only a month after Yashili announced a final dividend of 400 million yuan, equal to 85.4 per cent of its 2012 profit. It is puzzling because that's only two years after Yashili had raised 1.6 billion yuan via a Hong Kong listing and only weeks after it won approval to build a 700 million yuan plant.

Back then, Yashili said the special dividend was paid "in recognition of the continual support of the shareholders as it has excess cash for the group's present and future funding requirements".

If it doesn't appear to make any sense financially to Yashili, it makes every bit of sense for Mengniu as a buyer. The special dividend reduced Yashili's net asset value - four billion yuan at the end of last year - by one billion yuan.