Sinotrans slides amid gloomy dry bulk outlook

Shipping company's net profit slumps 78.1 per cent, leading to dip in shares

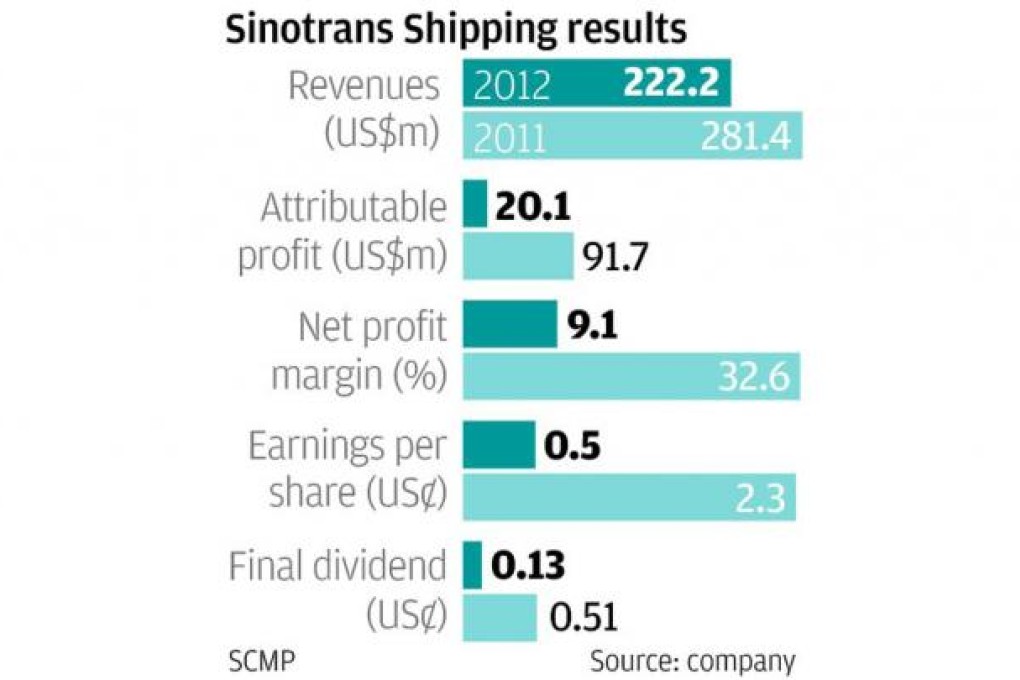

Shares in Sinotrans Shipping dropped more than 3 per cent yesterday after the firm said net profit slumped 78.1 per cent to US$20.1 million last year, down from US$91.7 million in 2011.

The stock fell 3.1 per cent to close at HK$2.16 as prospects for the dry bulk cargo sector, which contributed 89.8 per cent of total revenues of US$222.2 million last year, remain gloomy in 2013.

Xie Shaohua, chief financial controller, said "a large amount of fresh tonnage will pour into the [dry bulk] market" this year. He estimated there would be a 7.4 per cent increase in the dry bulk fleet this year based on figures from Clarkson, the British ship broking house. Although this would ease from the 10.3 per cent tonnage rise last year, Xie said there would be just moderate growth of 5 per cent in dry bulk seaborne trade volumes in 2013.

He said: "China was vulnerable to slower economic growth" that could affect the market.

Sinotrans Shipping operates 42 dry cargo and nine container ships. Executive director Li Hua said the container market's prospects were linked to economic recovery in the US and Europe.

Barclays analysts Esme Pau and Jon Windham said the net profit figure indicated Sinotrans Shipping barely broke even in the second half, making all the profits in the first half.