China’s third plenum: implications for solar power, copper, steel, oil refining and grains

- Next week’s big policy meet in Beijing will show how the government plans to approach problems around overcapacity and faltering demand

09:12

China’s third plenum: what to expect from the much-delayed policy meeting

Chinese commodities markets entered the second half with a bearish tilt, raising expectations that next week’s big policy meet in Beijing will show how the government plans to approach problems around overcapacity and faltering demand.

There’s a view that China is likely to provide more support for its economic recovery, but investors do not have a clear idea of how raw materials-heavy it will be, said Paul Bloxham, HSBC Holdings’ chief economist for global commodities.

“We are watching and waiting to see what gets delivered in the property, infrastructure and manufacturing sectors,” he said.

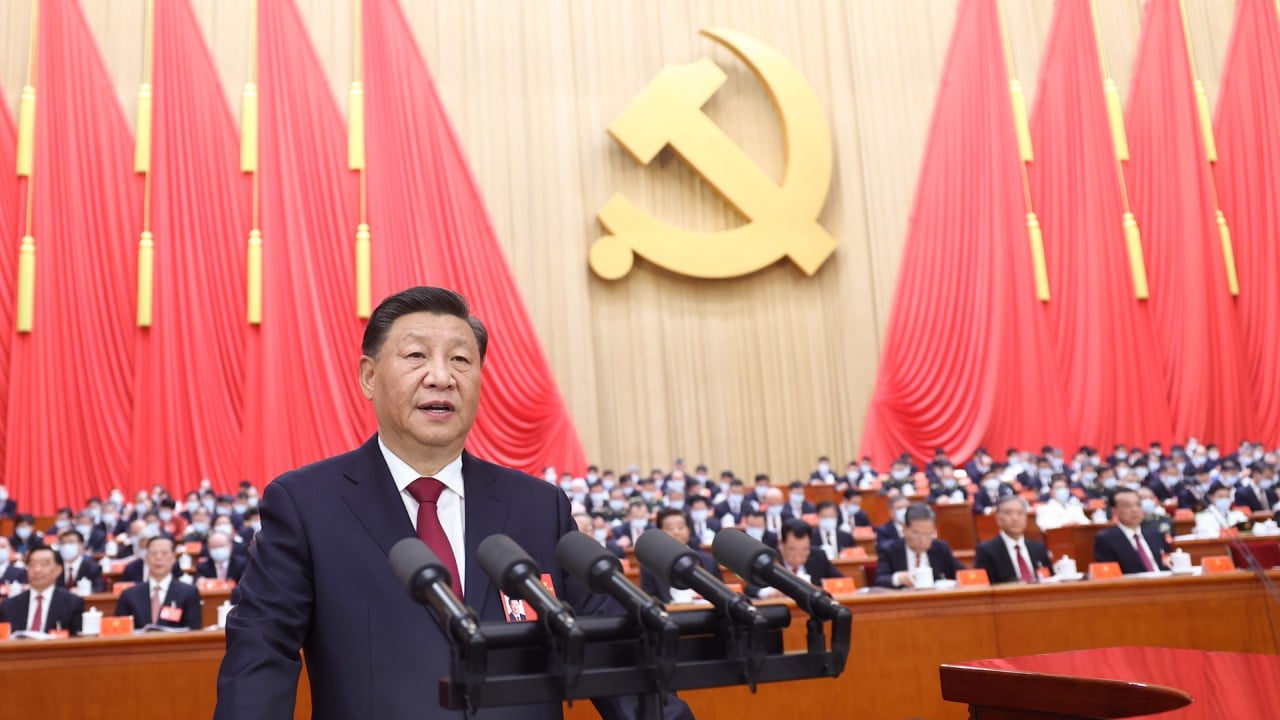

China is the world’s biggest importer of commodities and its dominant supplier of clean energy, so decisions taken in Beijing ripple across the world. Policies that address the energy transition, President Xi Jinping’s “new productive forces” in hi-tech industries and unified national markets are likely to have a direct impact on commodities supply and demand.

Other areas that could provide cues for bulls and bears alike include the housing crisis, tax and debt issues, and rural reform.