Hong Kong stocks drop to halt monthly gain on weak China manufacturing, corporate results

New World Development, state-owned banks lead plunge as market slips after best monthly performance since April

The Hang Seng Index fell 1.8 per cent to 17,670.72 at the noon break, backtracking after the benchmark rose almost 4 per cent in August for the biggest monthly gain since April. The Hang Seng Tech Index dropped 1.8 per cent, and the Shanghai Composite Index retreated 0.6 per cent.

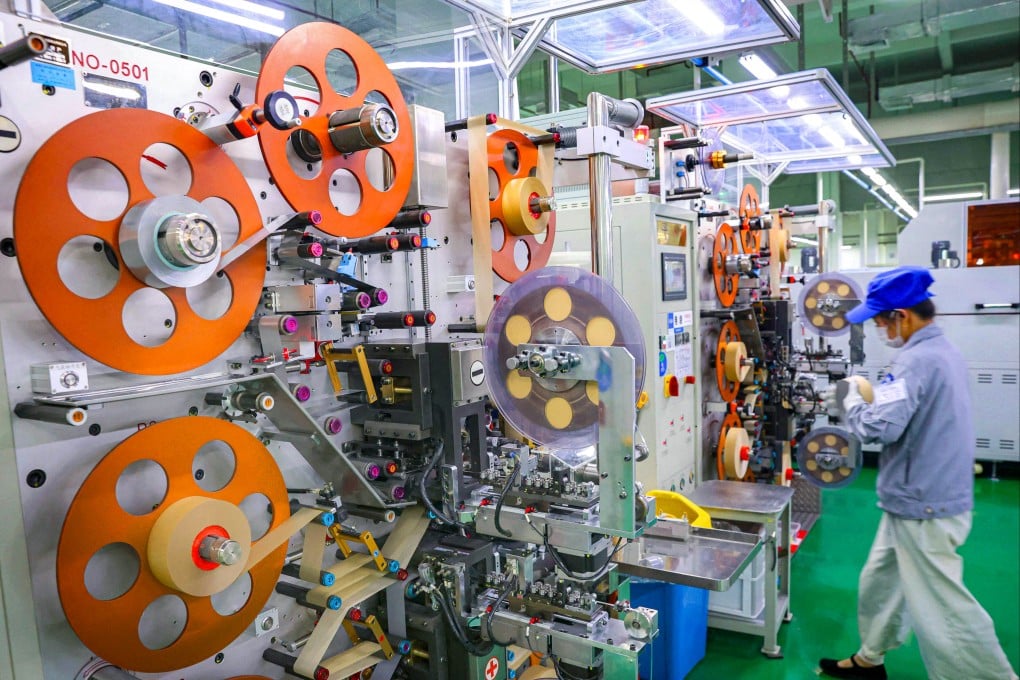

“China continues to play the role of buzzkill in the global Goldilocks scenario,” said Stephen Innes, managing director at SPI Asset Management in Bangkok. “The world’s second-largest economy is sputtering, with factory activity lagging, deflationary pressures mounting, and the call for stimulus growing louder.”

The rebound in Hong Kong in August may face a reality check as traders digest the weak results, which may trigger earnings downgrades. So far, 73 companies have disclosed interim results that average 4.9 per cent profit growth, according to Bloomberg data. That compares with a 6.1 per cent annual increase last year. The 3.7 per cent gain in the Hang Seng Index in August was mainly driven by expectations that the Federal Reserve will cut the interest rate for the first time in four years amid cooing inflation and a softening labour market.