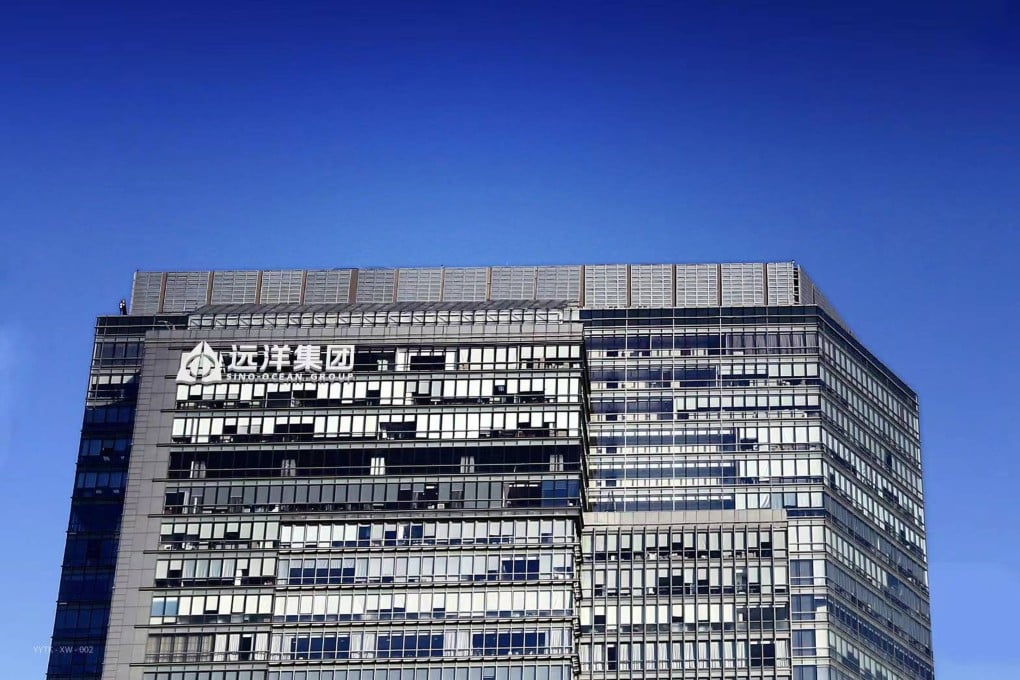

Exclusive | Bondholders urge Chinese defaulter Sino-Ocean to rejig US$6 billion debt plan after slamming big haircuts, weak recovery rates

- Beijing-based developer is required by a Hong Kong court to provide evidence against a winding-up petition later this month

An ad hoc group of bondholders, which owns more than 25 per cent of the group’s defaulted dollar-denominated bonds, is seeking a fairer solution from the Beijing-based company. It rejected the proposed reorganisation plan, citing deep haircuts and poor recovery rates imposed on many classes of creditors.

Sino-Ocean’s repayment plan, unveiled on July 18, will have a 63 per cent average haircut on creditors, according to an internal analysis produced by the ad hoc group. That ranks among the highest in restructuring involving defaulted Chinese property developers, a person involved in the matter said.

Some classes of creditors could face a 70 to 88 per cent loss, while bank creditors could escape with a 34 per cent setback, according to the analysis based on a 35 per cent discount rate. The bondholder group is advised by Linklaters and Haitong International.

Sino-Ocean had US$1.92 billion of syndicated and bilateral loans, as well as seven tranches of dollar-denominated bonds totalling US$3.72 billion, when it defaulted in September last year. The total claims have snowballed to about US$6 billion including accrued interest.

China’s property market has struggled to recover from a multi-year crisis, first triggered by Beijing’s “three red queues” policy and worsened by a slump in demand during the Covid-19 pandemic.