Europe’s EV battery hope fades as China pulls ahead while US subsidies undermine resources

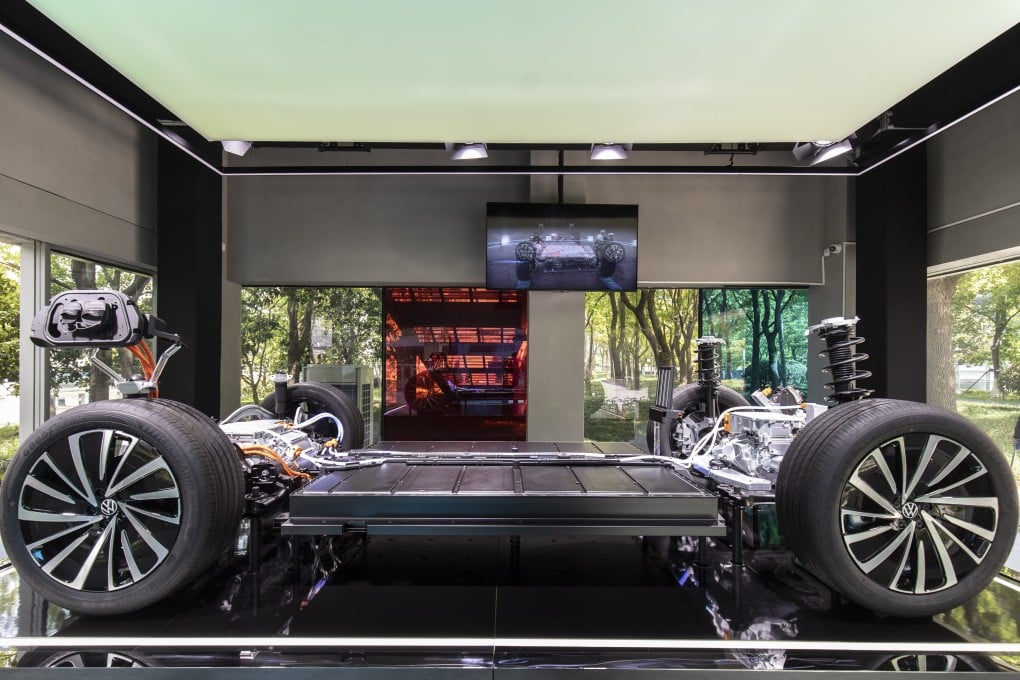

- As electric-vehicle sales slow, companies including Volkswagen , Stellantis and Mercedes-Benz are scaling back or refocusing battery projects

In 2019, France and Germany agreed to pump billions of euros into a plan to boost Europe’s battery industry and catch up with China and the US. Five years later, that effort is running out of steam.

China already has excess battery-making capacity, can make cells at a fraction of the cost it takes in Europe, and has a head start on the next generation of cell technology. All of this means the continent risks falling further behind in the race to build and power the EVs of the future.

“As a European company we need to change our mindset – we are changing from teachers to become students because we have to catch up on a significant backlog of experience,” Sebastian Wolf, chief operating officer of Volkswagen’s PowerCo battery unit, said on the sidelines of a conference in Stuttgart, Germany. “We have to all focus on becoming faster and becoming more cost efficient.”

Companies may cut back more on planned factories as European Union subsidies are hard to access due to bureaucracy and carmakers protect thin EV profit margins. VW may push out reaching full capacity for its €20 billion (US$21.5 billion) battery behemoth. Automotive Cells Company, led by Stellantis and Mercedes, has put on hold two of its three sites to weigh making lower-cost cells in light of slowing demand for still-expensive EVs.