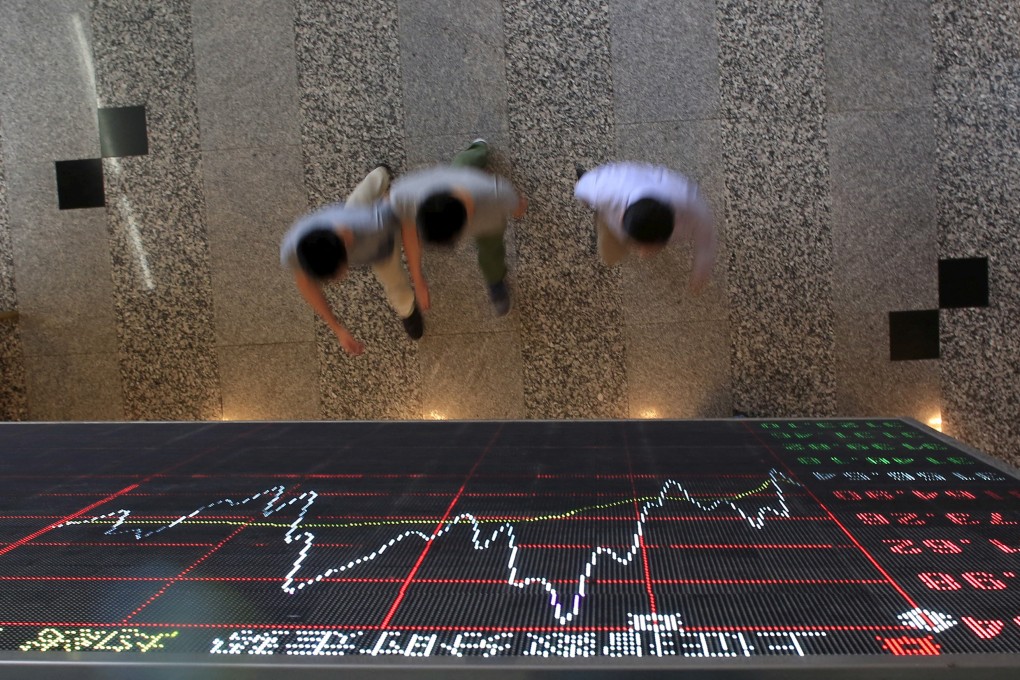

China’s market watchdog calms investors as it dismisses sudden surge in short-selling

- CSRC vows to step up oversight and severely punish irregularities, such as illegal stake reductions by big shareholders taking advantage of short selling

China’s securities regulator moved to soothe investors, after a social media post hyped up a spike in shorted stocks last week, its second attempt this month to talk up the market just as a rebound shows some signs of fizzling out.

The post, which was not identified, only played up the data on the new shorted stocks while overlooking the figures of the stocks whose short positions were closed out due to their removal from stock gauges after the review, the watchdog said.

The outstanding number of shorted stocks dropped by 460 million on June 11 and 12, with an equivalent decrease in value by 5.4 billion yuan (US$744.3 million), the CSRC said.

“Going forward, the CSRC will fully evaluate and fine-tune the rules on short selling and strengthen the counter-cycle adjustment,” the watchdog said. “At the same time, we will step up oversight and severely punish irregularities, such as illegal stake reductions by big shareholders taking advantage of short selling.”