Advertisement

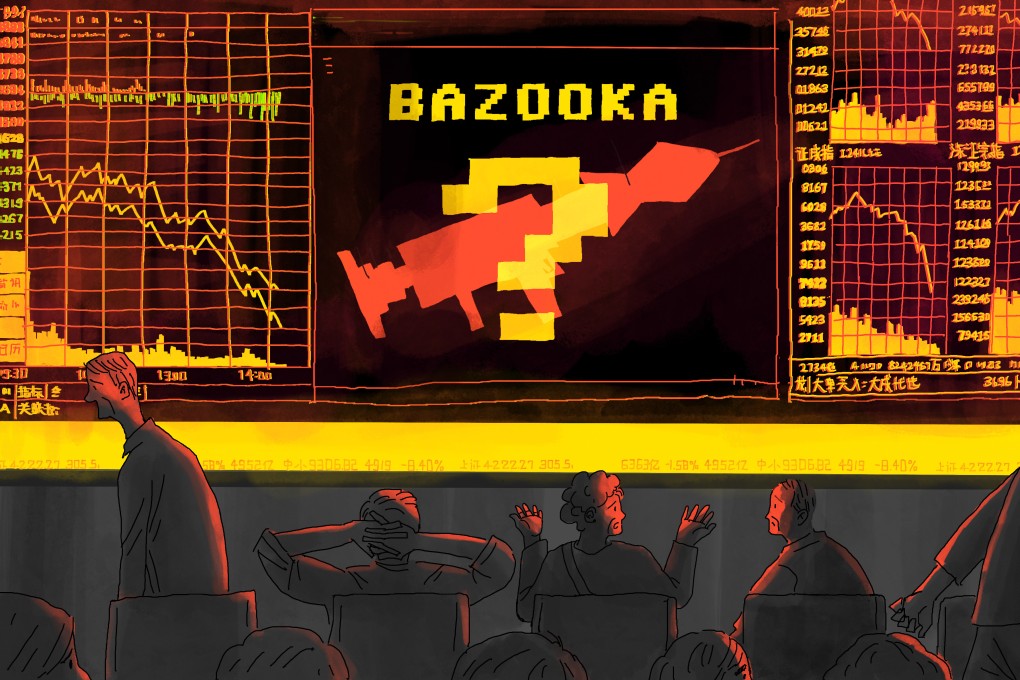

Analysis | China’s desperate stock traders keen for policy ‘bazooka’ to rouse US$10 trillion bear market from slumber

- Many of mainland China’s 220 million retail investors are not convinced the government’s recent support measures are enough to ensure long-term recovery

- Sentiment has been shaky for some months, as expectations of a strong post-Covid economic recovery failed to materialise

Reading Time:6 minutes

Why you can trust SCMP

55

Zhang Shidongin Shanghai

Software engineer Jacky Jia has been paying more attention than usual to his stocks portfolio since China launched a torrent of measures aimed at boosting the beleaguered market in recent weeks.

Regulators have slashed the stamp duty on transactions, restricted divestments by major shareholders and taken tighter control of approving new share offerings in a string of actions that have taken the immediate sting out of the sell-offs that have roiled the onshore market.

Having banked a reasonable return on the back of this, 45-year-old Jia is toying with the idea of investing a fixed amount of his salary in stocks every month going forward.

But something is holding him back. Like many of the 220 million retail investors at home, he is not fully convinced the government’s efforts go far enough to set equities on a path to long-term recovery.

“I’m about 60 per cent confident in the market,” said Jia, who works for a Japanese software company in Shanghai, in a recent interview. Despite the positive vibes on the policy front, “there’s no significant improvement in fundamentals,” he said. “The key issue is the lack of money and confidence. Of course, confidence matters more.”

The task of restoring that confidence, among both retail and institutional investors, rests with the China Securities Regulatory Commission (CSRC), the watchdog that oversees the nation’s US$10 trillion stock market. President Xi Jinping’s all-powerful Politburo made its move in a meeting in July, setting the tone for second-half economic policy.

Advertisement