Advertisement

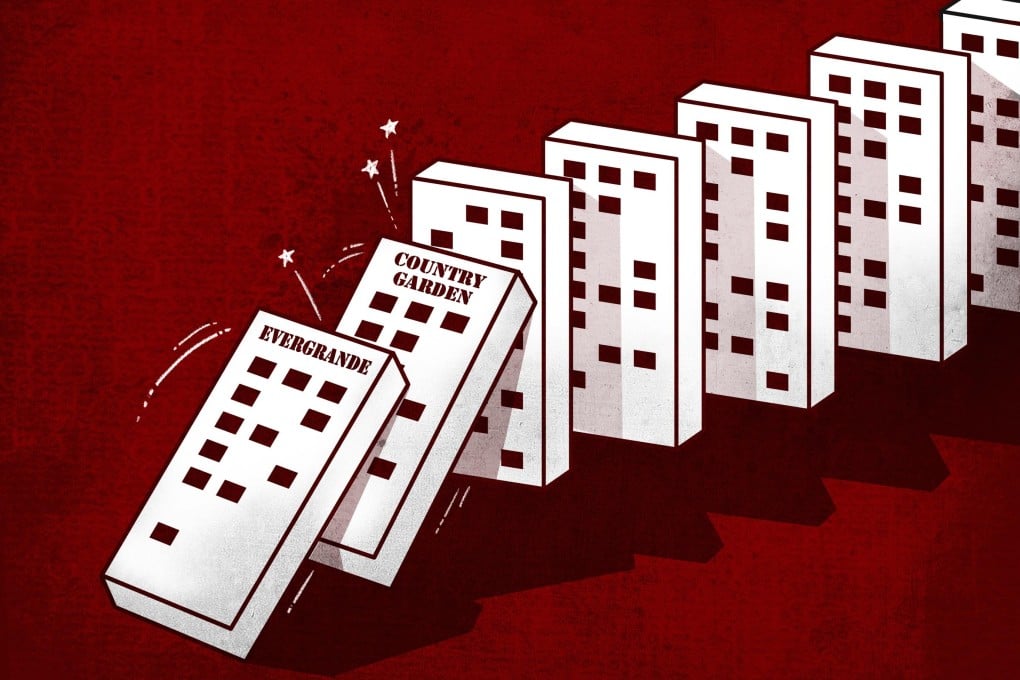

China property crackdown: why surprise victim Country Garden could be worse than Evergrande for the economy

- Country Garden has a lower debt load than Evergrande, but plays a bigger role in China’s sputtering housing market given its wider footprint in lower-tier cities

- Developer faces US$2.5 billion in coupon repayments and bond maturities before year’s end, according to analysts at JPMorgan

Reading Time:6 minutes

Why you can trust SCMP

24

The catastrophic crash in Country Garden Holdings, once the gold standard in China’s property industry, has cost stock and bond investors steep losses. Now, the developer stands to potentially inflict wider damage on the economy than the high-profile default of China Evergrande Group.

The company’s stock has declined 67 per cent this year, knocking HK$49.2 billion (US$6.3 billion) off its market capitalisation and shrinking its market value to US$3.1 billion, as a cash crunch took the market by surprise. Its US$14 billion of outstanding local and foreign-currency bonds have lost at least 90 per cent of their face value, according to Bloomberg data.

An imminent ejection from the benchmark Hang Seng Index and several deadlines in the next few days on principal and interest payments will keep the risk of default elevated and the crisis in focus.

“Country Garden was considered the darling of real estate developers when Evergrande defaulted on its debt back in late 2021, as it had a much better-managed balance sheet,” Alicia Garcia Herrero, Natixis chief economist for Asia-Pacific, said in an August 21 research note. “The rapid worsening of Country Garden’s profitability is a sign of how systemic real estate problems are in China.”

Country Garden has convinced most onshore investors to extend the maturity of a corporate bond due on September 4. A 30-day grace period to make good on missed offshore bond interest payments in August will expire a few days later. Failure to pay could trigger a cross-default, including some of its 156 billion yuan (US$21.5 billion) of bank borrowings.

Country Garden declined to comment when contacted for this story.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2-3x faster

1.1x

220 WPM

Slow

Normal

Fast

1.1x