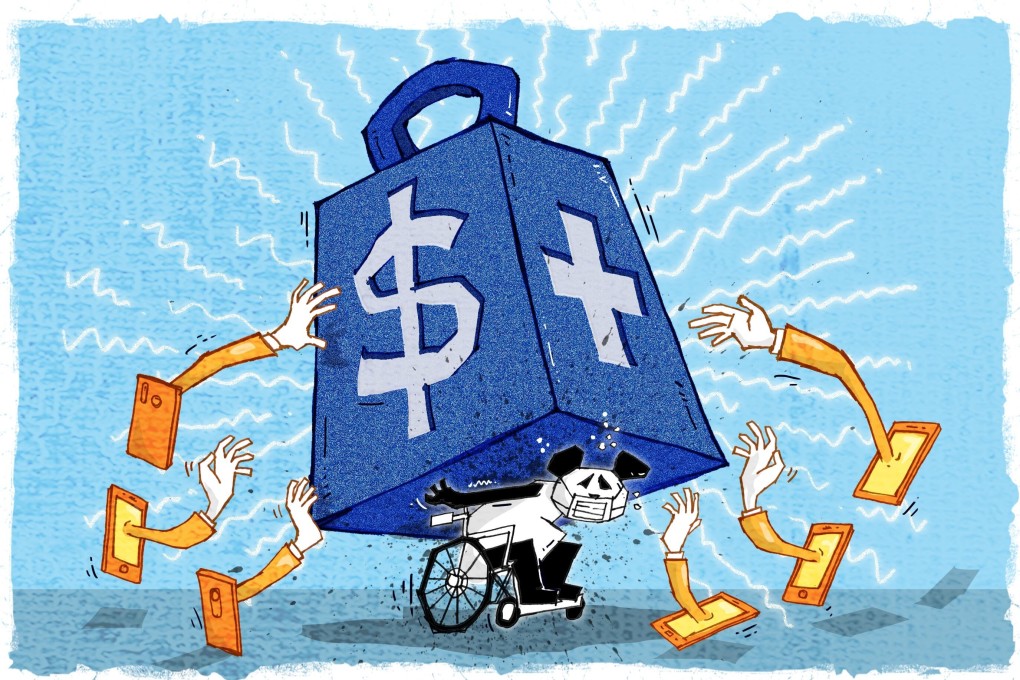

Technology turbocharges China’s access to health insurance amid coronavirus pandemic – for the price of a Starbucks coffee

- Mutual-aid platforms offering insurance-like have garnered some 300 million members sharing the burden of medical claims

- Online sales of insurance products are likely to accelerate as technology takes centrestage during Covid-19 pandemic

“I cried,” the 35-year old mother of two said in an interview by email. “While cancer can be treated, the medical cost is just so high that my family simply could not afford it.”

Thanks to Xiang Hu Bao, though, Xiao’s medical bill was collectively paid by more than 104 million members of the so-called mutual health protection platform, a trailblazing hybrid product of technology and commerce in China’s burgeoning sharing economy.

Members of Xiang Hu Bao pay nothing to enjoy up to 300,000 yuan of insurance-like coverage each for some 100 serious illnesses on the platform launched in October 2018, and split the bills whenever one goes for treatment.

In its first full year of operation in 2019, each member paid 29.17 yuan, less than the price of a cup of Starbucks coffee in Shanghai or a mid-sized Big Mac in London. This year, the operator Ant Financial Services has capped the cost at 188 yuan per head, and provides free Covid-19 coverage for up to 100,000 yuan.

Ant Financial, which also runs the nation’s biggest online payment system known as Alipay, is an associate of Alibaba Group Holding, the owner of South China Morning Post.