Corporate China hit by worst earnings on record in 2018, as trade war bites

- Losses related to goodwill soared to a record 166 billion yuan (US$24.65 billion) last year

- Technology among sectors worst hit, but construction materials, defence make gains

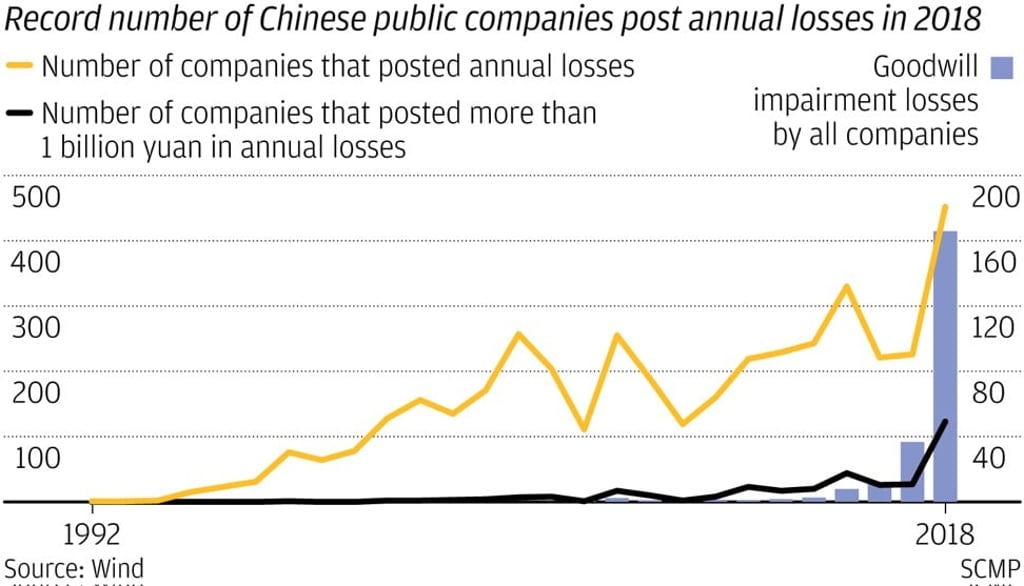

This is the worst annual earnings season ever for China’s corporate sector, with a record 452 out of 3,602 public companies incurring annual losses, as the effects of the year-long US-China trade war seep into corporate earnings.

By the end of April, the number of loss-making companies had doubled from 2017, while the proportion of such companies also hit an all-time high of 12.5 per cent, according to data provider Wind. The combined net profit of companies listed on the Shanghai and Shenzhen stock exchanges reached 3.383 trillion yuan (US$502 billion) for 2018, down 1.7 per cent from the previous year.

Losses related to goodwill – the intangible asset that arises when a company acquires another business – also soared to a record level of 166 billion yuan (US$24.65 billion), tripling the amount from the previous 11 years combined, at 871 companies. This is because a record number of companies that were ambitious and pushed up the goodwill value of acquired assets during the boom years, are now rushing to write down these values, as the trade war and a government deleveraging crackdown bite into their profitability and worsen their financial woes, according to analysts.

And the worst may not be over.

“We don’t know if it’s the bottom of corporate earnings yet, as the final result of the trade war is pending and the macroeconomy is still in a downward trend,” said Chen Xikai, an analyst with Shanghai-listed Industrial Securities.