Having dumped US$25 billion in assets, Wanda still about halfway through cutting its debt burden

- Company has agreed to invest about US$8 billion in ‘red tourism’ projects to weather the storm

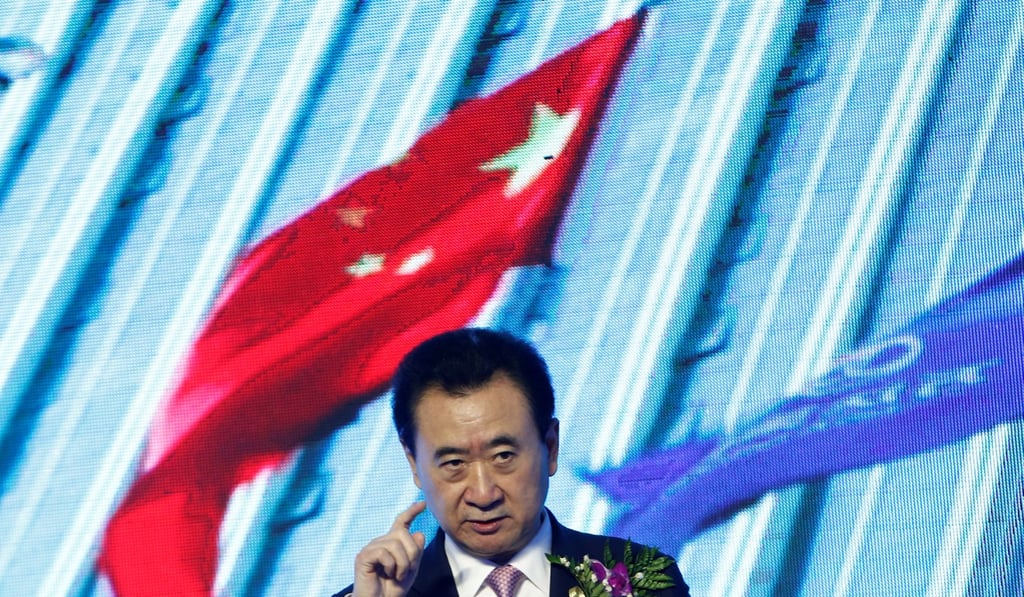

- Owner Wang Jianlin’s net worth has plunged by about 37 per cent to US$20.2 billion

Dalian Wanda Group has gone through a severe slimming exercise ever since it was placed on a watch list by Chinese regulators in April 2017 – for highly leveraged acquisitions around the world – as part of a government drive to crack down on debt and prevent private-sector borrowings from hurting China’s financial system.

Other companies on the watch list include Anbang Group, HNA Group, Fosun Group and CEFC China.

Wanda, the flagship of Wang Jianlin, China’s wealthiest man, is not halfway through selling assets to repay debt, based on an analysis of his assets and liabilities. As of the end of March, Wanda’s balance sheet had shrunk by more than 170 billion yuan (US$25 billion) from end 2016, or more than 20 per cent.

It still faces 182.2 billion yuan in debt obligations, including bonds and loans, an equivalent to 30 per cent of its current total assets.

“Over the past two years, Wanda has furiously shrunk its balance sheet by more than 20 per cent. And its unwinding will continue, as it still faces more than 180 billion yuan in short and medium-term debt obligations,” said Brock Silvers, managing director at Kaiyuan Capital in Shanghai.