Regulator wallops Chinese railcar owner with a US$870 million fine for manipulating stock prices

The fine, already 70 per cent of last year’s total penalties, is a sign of the regulator’s determination to instil discipline and punish malfeasance in the financial markets

China’s securities regulator has slapped a record 5.5 billion yuan (US$870.6 million) fine on a company for manipulating stocks, the biggest single penalty in the country’s financial industry, in a move that underscores the government’s determination to impose discipline in the freewheeling capital market.

Xiamen Beibadao Group, the country’s largest private owner of cargo railcars, was penalised for being complicit in manipulating the stock prices of Zhangjiagang Rural Commercial Bank, Jiangyin Rural Commercial Bank, and Guangzhou Hoshion Aluminium, all of which are listed in Shenzhen.

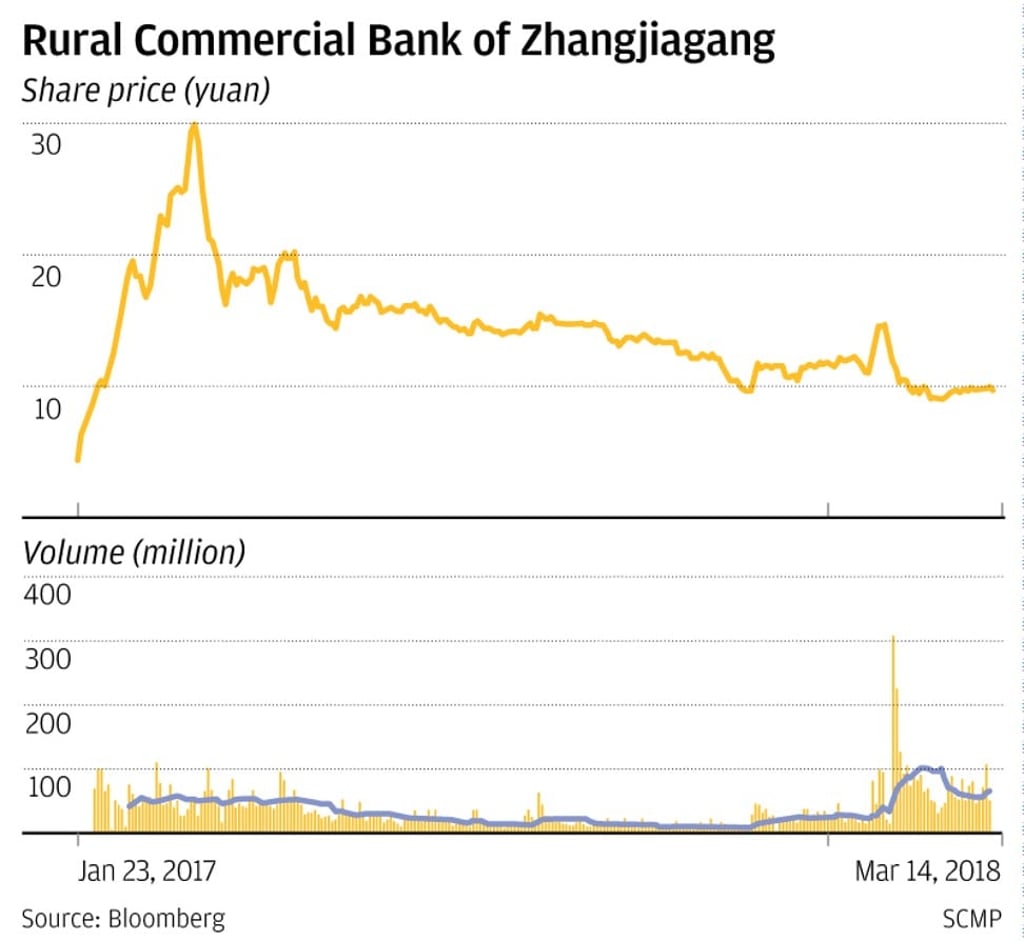

Shares of the three companies fell after the penalty was announced. Zhangjiagang’s shares fell by as much as 4.6 per cent, while Jiangyin’s stock posted an intraday loss of 2.3 per cent and Hoshion’s dropped by as much as 1.9 per cent.

Beibadao used borrowed money in more than 300 stock trading accounts to manipulate prices in the three companies, earning itself 945 million yuan in trading profits, according to the regulator’s statement.

Prices of the three stocks, which all more than doubled in February 2017 and reached record highs between March and April, have since plunged from their highs. Zhangjiagang has plunged 70 per cent from hits peak, while Jiangyin has fallen 69 per cent and Hoshion has plummeted 65 per cent from its high.

People involved in the case had refused to cooperate with investigators, and even resorted to physical altercations and attempts to destroy evidence, the regulator said. Beibadao officials could not be reached to comment.