Update | Hong Kong government pledges cautious approach to easing mortgage plight of first-time buyers

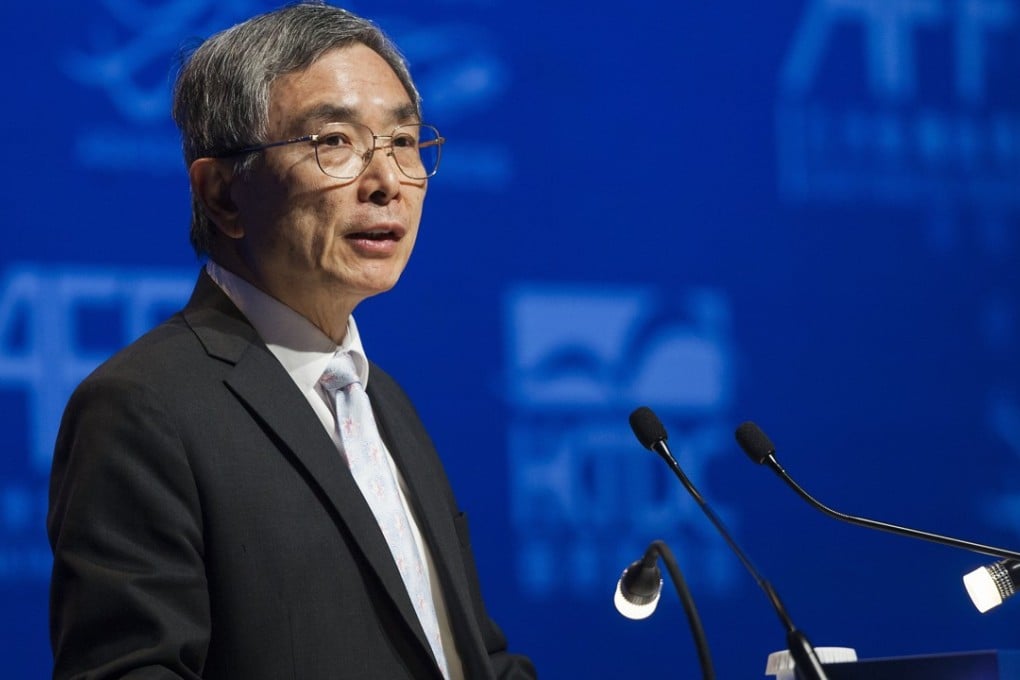

‘Any potential changes to the mortgage policy would be aimed solely at helping first-home buyers … it does not mean the government has any intention of relaxing the many policies that were introduced to curb property prices’, says James Lau, secretary for financial services and the treasury

The Hong Kong government is taking a cautious approach in the plans to review its mortgage policy for first-time buyers, according to James Lau, the secretary for financial services and the treasury – but any such move must be carefully thought out, so as not to add further fuel to what is an already overheating property market in the city.

“The government needs to be very cautious in launching any mortgage policy aimed at helping youngsters or any other members of the public to buy their own home,” Lau said on the sidelines of the 11th Asian Financial Forum in Hong Kong. “We need to ensure any new policy simply doesn’t make it easier for speculators to re-stimulate the property market further.”

“Let me make it quite clear – any potential changes to the mortgage policy would be aimed solely at helping first-home buyers. And it does not mean the government has any intention of relaxing any of the many policies introduced to curb property prices,” Lau said.

His remarks came after Financial Secretary Paul Chan Mo-po last week told lawmakers that the government-owned Hong Kong Mortgage Corporation (HKMC) was considering new policies to help youngsters or first-time homebuyers.