China's online finance platforms face uncertain outlook

Growth in the two darlings of mainland China internet finance - online money market funds and peer-to-peer lending (P2P) - have slowed after last year's freewheeling boom.

Growth in the two darlings of mainland China internet finance - online money market funds and peer-to-peer lending (P2P) - have slowed after last year's freewheeling boom.

Held up as examples of home grown innovation in internet finance, they were largely borne out of the liquidity crisis in China's interbank market that started late in 2013.

At their peak, the two online platforms transformed the Chinese public into "reverse ATMs" where capital could be sourced from the masses, plugging gaps in the banking system by directly allocating funding where it was needed.

"There will be a crackdown on P2Ps. However, regulators are unlikely to intervene in a major way [because] deterring individual platforms could be like creating a credit event that could have a chain reaction across the industry," said Howhow Zhang, the former head of research of Z-Ben Advisors.

Caught between stock market rallies earlier this year and the crush of money market fund returns, some investors looking for higher yield alternatives turned to P2Ps, online crowd-funding platforms where investors pool funds to lend to individuals or companies that may otherwise have been turned down by banks for credit.

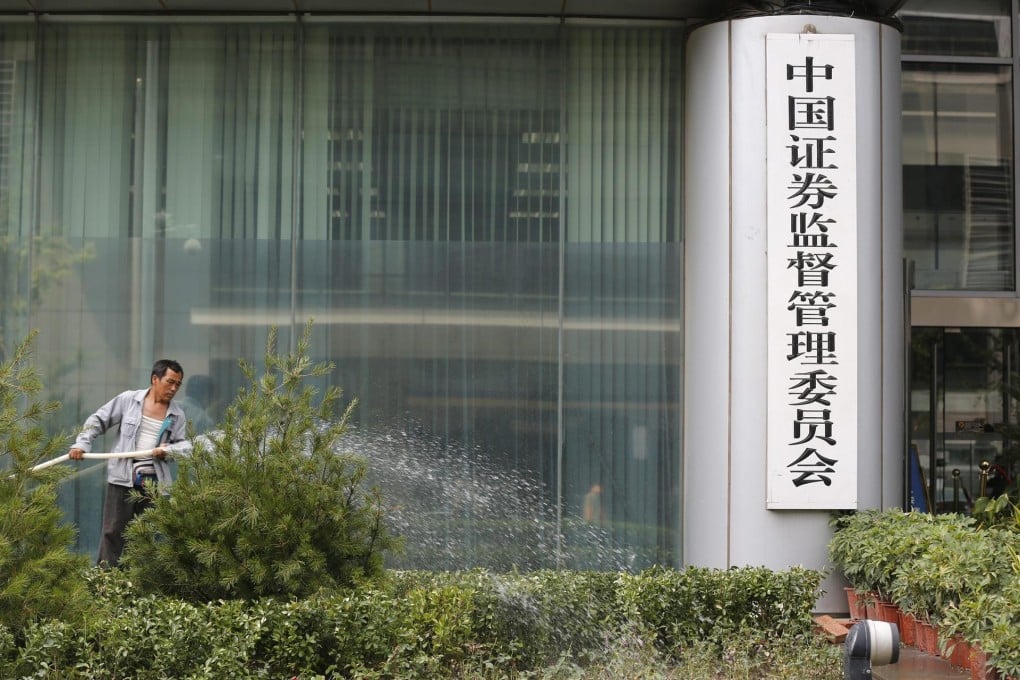

However, unlike money market funds, which are strictly regulated by the China Securities Regulatory Commission, P2P platforms have remained largely unregulated.