Deloitte says cost pressures cloud industry outlook

Mainland firms facing slower growth, lower liquidity and surging gearing amid policy curbs

While mainland property firms have enjoyed growth in sales and market capitalisation over the past few years, Deloitte China is less optimistic about the future.

The professional services firm cites pressures on profitability from slower growth, lower liquidity and surging gearing.

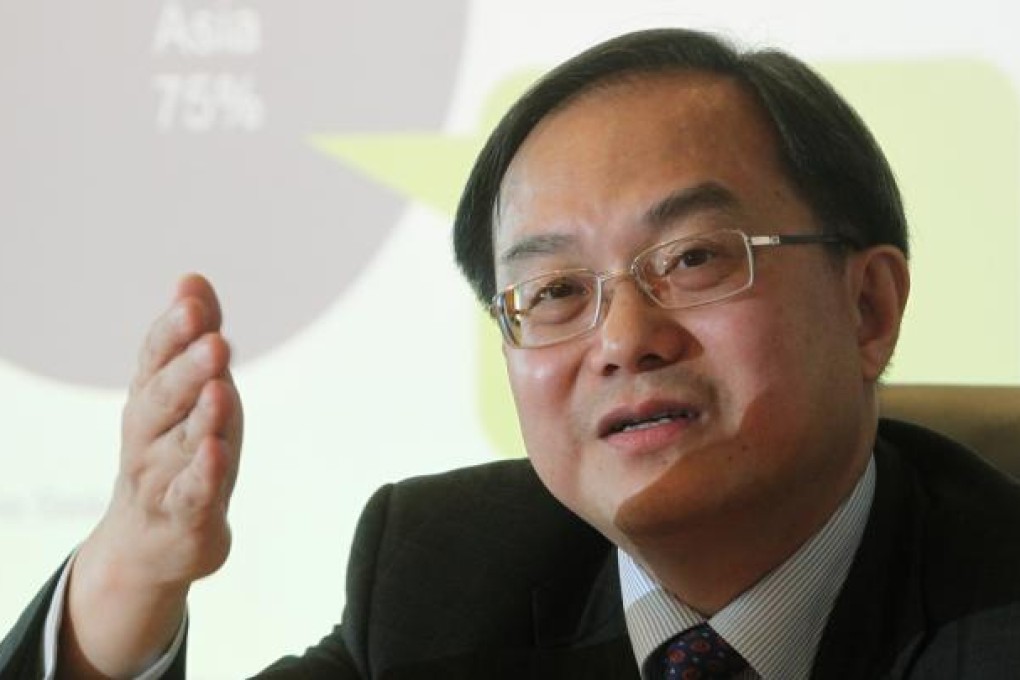

"Cost pressures have been mounting on Chinese property companies since 2011, leading to a staggering increase in their finance expenses by about 44 per cent as a result of the mainland government tightening its monetary policy," said Richard Ho, a national real estate industry leader at Deloitte China.

"The impact from high land premiums paid since 2009 has started to surface since 2012 and onwards, weighing heavily on profitability."

The firm suggested in its latest property research report that the mainland property sector would remain significantly influenced by the regulatory regime and administrative measures because of the government's long-term commitment to combating high property prices.

Gary Fung, a tax partner at Deloitte China, said in the report the government was unlikely to loosen its control over property prices, but he said the policy had not been substantively tightened.