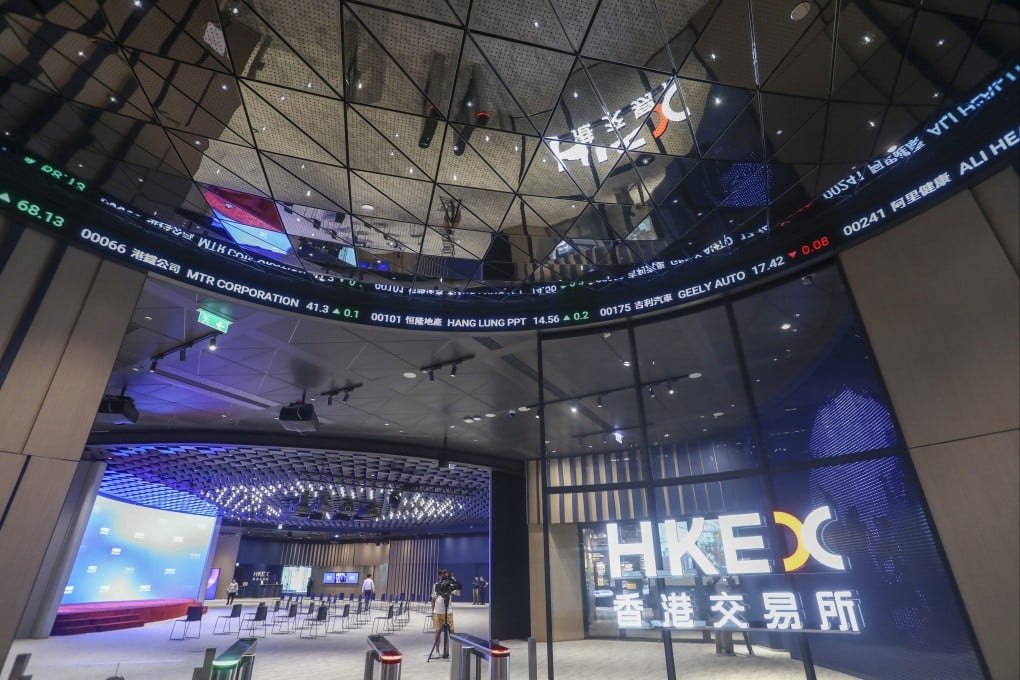

ETFs are hot in Hong Kong as volatile stock market drives traders to exchange-traded funds

Net fund flows have surged 48 per cent year on year, with an ETF tracking the Hang Seng Index surpassing Tencent in daily volume

Hong Kong’s exchange-traded fund (ETF) market is logging a record year thanks to the recent market rally, expanded inclusion in the cross-border Stock Connect programme and a series of new products, including Asia’s first pegged to virtual assets.

Net fund flows of Hong Kong’s exchange-traded product (ETP) market, which includes ETFs and leveraged and inverse products, surged 48 per cent year on year to HK$46.7 billion in the first 10 months, according to HKEX data. That brought the ETP market’s total assets under management (AUM) to nearly HK$500 billion.

The markets have been volatile as investors await more fiscal stimulus moves and observe the implementation of the measures in China.

He added that ETFs accounted for more than 15 per cent of the overall cash market trading volume during the recent spike.