Advertisement

Sovereign investors look to emerging markets as geopolitical tensions rise, says study

- Geopolitical tensions have surpassed inflation as the primary concern for sovereign investors, prompting them to invest more in emerging markets and gold, Invesco survey finds

Reading Time:3 minutes

Why you can trust SCMP

Geopolitical tensions have surpassed inflation as the primary concern for sovereign investors, prompting them to invest more in emerging markets and gold, according to a new survey.

Advertisement

Eight out of 10 sovereign wealth managers or central banks view geopolitical tensions as a major risk to global growth in the next year, up from 72 per cent in 2023, according to the survey by Invesco released on Monday.

The annual study by the US financial firm collected the views of 140 chief investment officers and other key executives of sovereign wealth funds (SWFs) and central banks who managed a total of US$22 trillion as of March.

“Longer-term risks [geopolitical tension] have become more salient as inflation has fallen back towards central bank targets,” said Martin Franc, Invesco CEO of Asia ex-Japan in a statement.

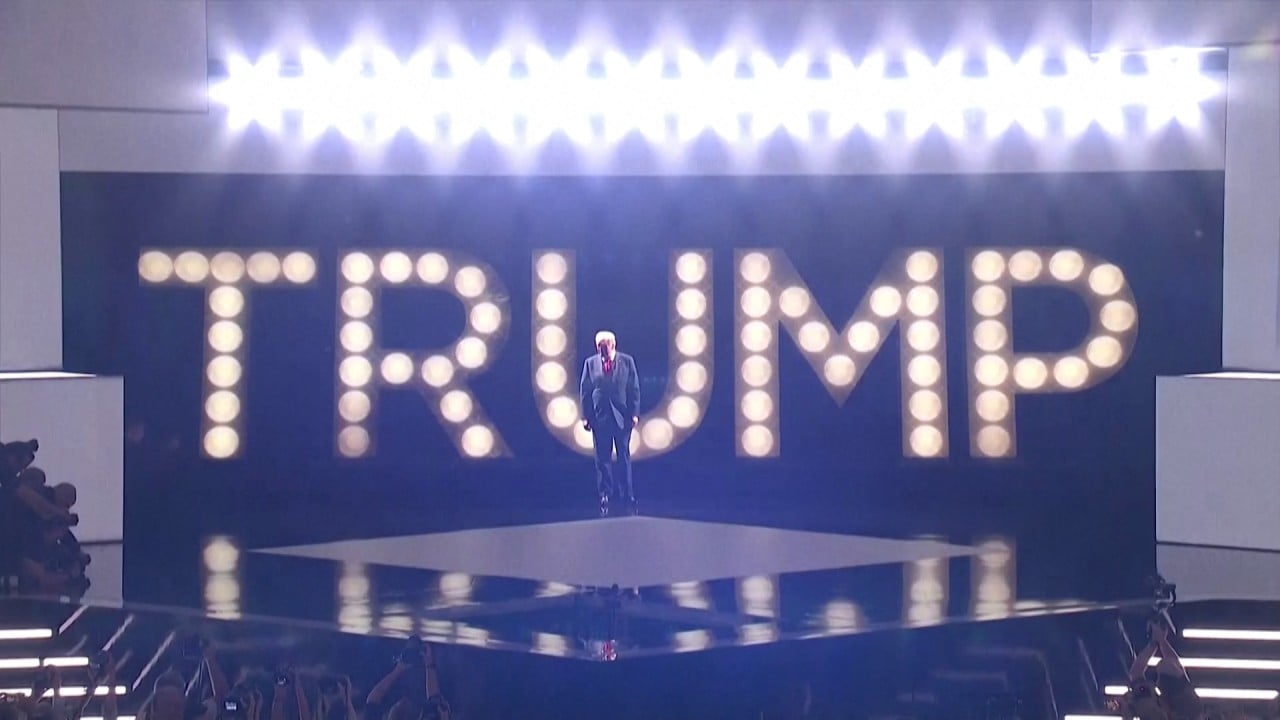

“Meanwhile, elections across major markets over the past year have proven difficult to predict.”

US President Joe Biden has just dropped his US re-election bid, prompting markets to worry the election in November may go the way of Donald Trump, who has warned he would increase tariffs on Chinese goods.

Advertisement

Advertisement