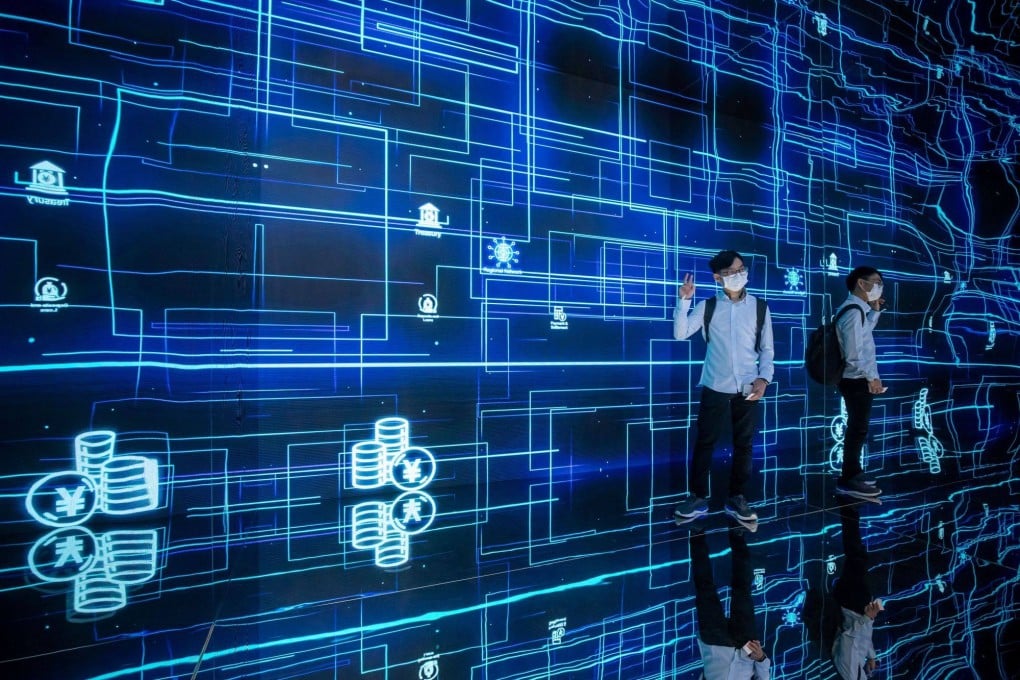

Project mBridge e-currency project involving Hong Kong, mainland China hits landmark

- Saudi Central Bank joins central bank digital currency project as it announces minimum viable product, opening door for further cooperation

A multi-country central bank digital currency (CBDC) project involving mainland China, Hong Kong, Thailand and the United Arab Emirates has made a breakthrough by launching its minimum viable product (MVP) platform, which will serve as a proving ground for more use cases in cross-border transactions.

Since the project began in 2021, the four founding monetary authorities and the Bank for International Settlements (BIS) Innovation Hub have worked to utilise digital currencies built on distributed ledger technology (DLT) to enable instant cross-border payments and settlement.

The MVP platform, based on a new blockchain called mBridge ledger, will serve as a “test bed for add-on technology solutions, new use cases and interoperability with other platforms”, the BIS and the Hong Kong Monetary Authority said in separate press releases on Wednesday.

Private sector firms are also invited to propose solutions and use cases to further develop the platform.