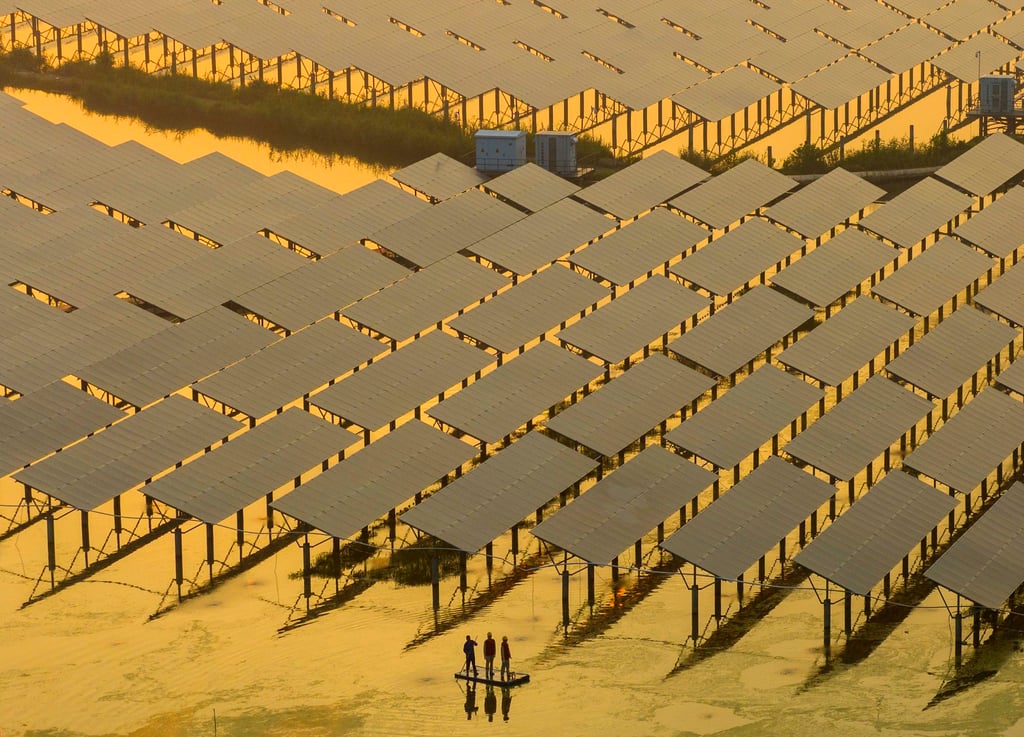

China stokes Asia-Pacific demand for sustainable finance despite rising interest rates, driven by Beijing’s carbon ambitions

- In Asia-Pacific excluding Japan, green and sustainability-related bonds helped raise US$134 billion in the year so far, with China accounting for more than half the volume

- The region is highly exposed to costly climate change-related events and needs to invest US$71 trillion to achieve net-zero emissions by mid-century

Investing in firms and industries to help fund their transition to a low-carbon future is set to become a major theme in 2024, as demand for sustainable finance products in China and the Asia-Pacific region will remain robust despite elevated interest rates, fund managers and analysts said.

Sectors in need of transition such as building materials, and companies which are looking to lower emissions and raise spending on green tech, will be attractive investment bets going forward, said Brendan Tu, Asia-Pacific head of ESG advisory at UBS in an interview.

“A more favourable interest rate environment in 2024 can be conducive to increased issuance of green bonds or sustainability-linked bonds,” said Tu. “But we need to find a variety of transition financing to support companies’ decarbonisation initiatives.”

Sustainable debt is tied to investments financing the transition to a low-carbon economy, either via funding new or more efficient power generation, or helping companies achieve their decarbonisation targets, said Jakub Malich, environmental, social and governance (ESG) and climate research lead for fixed income at index compiler MSCI.