VC deal value in Asia falls in second quarter but optimism grows about pick-up in IPOs in Hong Kong and China, says KPMG report

- VC deal value in Asia in the second quarter was US$20.1 billion, down from US$35.1 billion in the same period last year

- KPMG says increased support from local governments in China and collaboration with VC firms has bolstered investment in start-ups

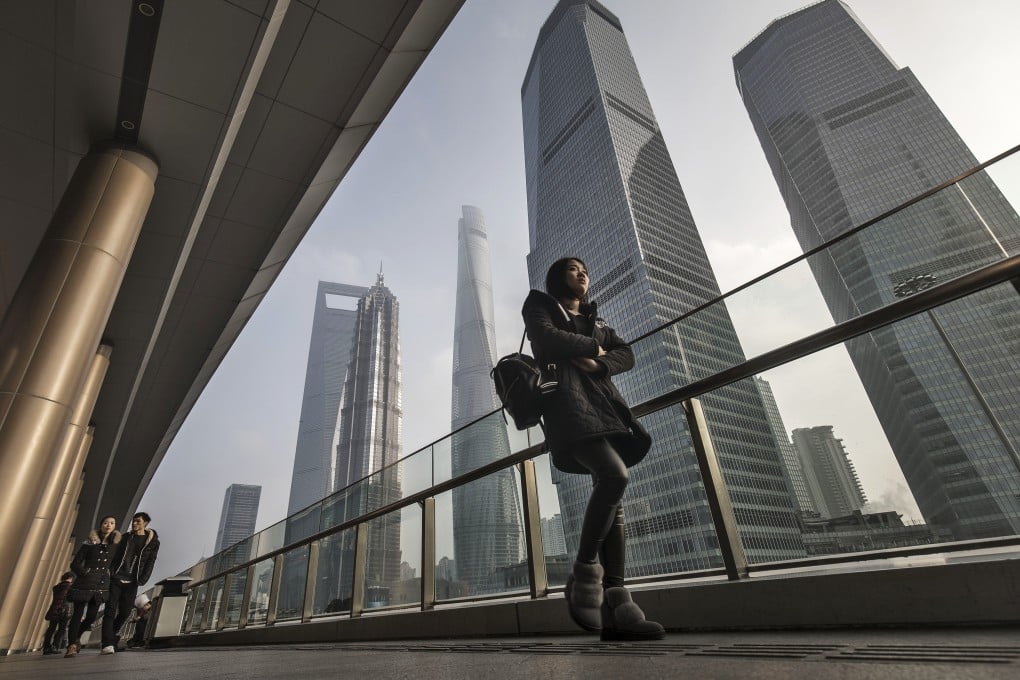

There is growing optimism among venture capital (VC) investors in Asia about an increase in initial public offerings (IPOs) in mainland China and Hong Kong, despite an overall fall in VC deal value in the second quarter, according to a report by consultants KPMG.

VC deal value in Asia in the second quarter was US$20.1 billion, down from US$35.1 billion in the same period last year, with China venture financing accounting for US$9.3 billion of this. Although this was the sixth straight quarterly decline in a row, KPMG highlighted pockets of strength.

“Venture capital investment remained muted in China this quarter, although the overall economy in the country continued to make a slow rebound,” said Zoe Shi, partner at KPMG China.

Shi added that increased support from local governments in China and collaboration with VC firms had bolstered investment in start-ups and boosted sentiment in the overall ecosystem.

The second quarter decline in Asia deal value came despite a US$2 billion capital-raising by Singapore-based online retailer Shein and a US$700 million capital-raising by India-based edtech start-up Byju’s.