Advertisement

Fitch lifts Hong Kong banking sector’s outlook to ‘improving’ from ‘neutral’, citing strengthening economic recovery

- Fitch Ratings says it expects solid net interest income, improving fee income and moderating credit costs to drive double-digit profit growth for sector this year

- Hong Kong banks’ impaired loan ratios are likely to stay elevated in the near term because of their exposure to the mainland’s distressed real estate sector

Reading Time:3 minutes

Why you can trust SCMP

Elise Makin Beijing

Fitch Ratings revised its outlook for Hong Kong’s banking sector from “neutral” to “improving” to reflect banks’ stronger earnings prospects in the second half of this year.

Advertisement

Analysts at the ratings agency said the ongoing economic recovery in Hong Kong and mainland China after the border reopening will support the banks’ business volumes, especially in the latter half of the year.

“We expect solid net interest income, improving fee income, and moderating credit costs to drive double-digit profit growth for the sector in 2023,” Fitch analysts led by Matt Choi said in a research note on Thursday.

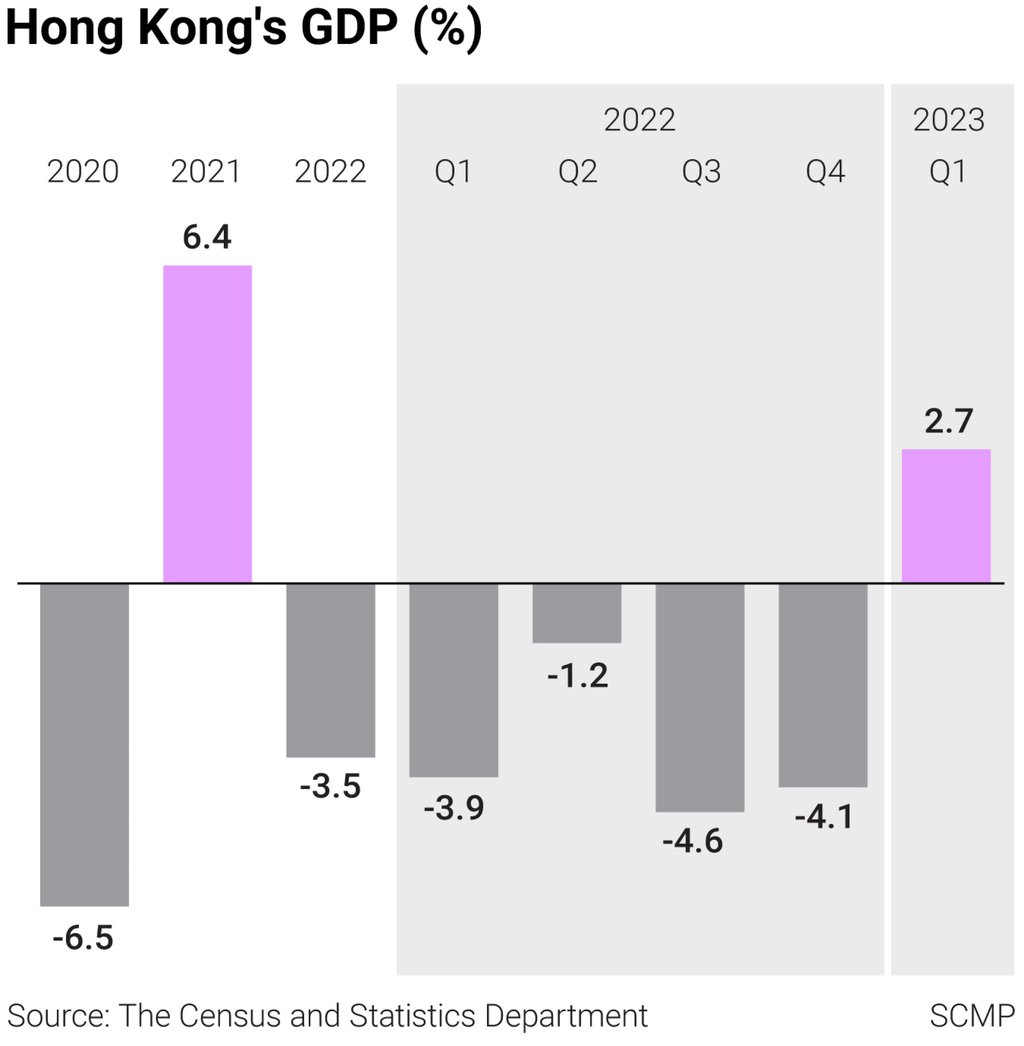

Metrics improved across the board in the first quarter. Strong retail sales helped Hong Kong’s gross domestic product to grow by 2.7 per cent after four consecutive quarters of contraction. Fitch has forecast 4 per cent growth for the city’s economy in 2023 on the back of more local social activities and a surge in tourist arrivals from the mainland, after growth contracted 3.5 per cent last year.

The improving economy was reflected in the better-than-expected first-quarter profits at Hong Kong’s biggest banks, HSBC and Standard Chartered.

Advertisement

Advertisement