HSBC investors reject minority shareholders’ proposal to spin off Asia business, raise dividend payouts

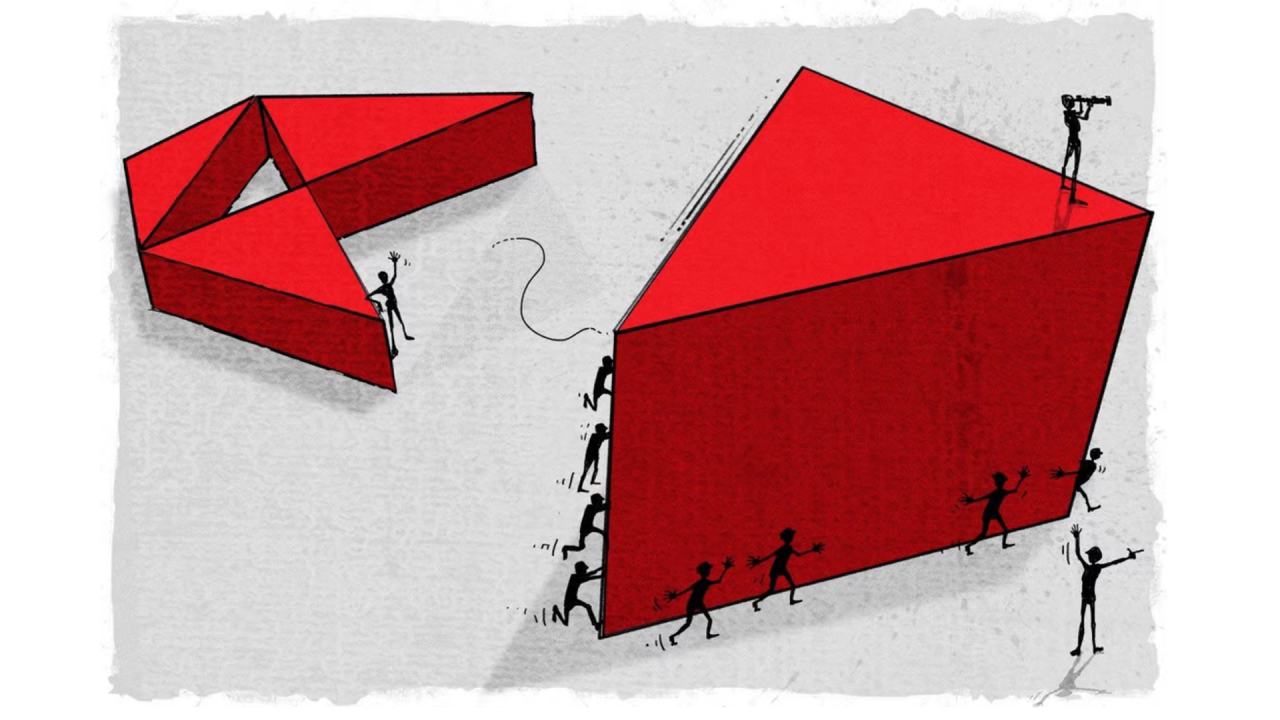

- Minority shareholders had called for the bank to consider radical change, including an overhaul of its structure

- Ping An, HSBC’s biggest shareholder, has also been pushing the lender to make changes to enhance shareholder value

The minority investors, led by Ken Lui Yu-kin, the leader of the “Spin Off HSBC Asia Concern Group”, had called for the bank to consider a significant shake-up to drive shareholder value, including spinning off its business in Asia. They also sought to return the bank’s annual dividend to pre-pandemic payout levels of 51 US cents a share.

“Being global is how we generate a significant portion of our revenues and is central to our whole strategy,” HSBC chairman Mark Tucker said in a speech on Friday before the vote tally was announced. “A restructuring or spin-off would mean that we lose this revenue as our bank would no longer have the connectivity which our customers value.

“It would not be in shareholders’ interests to split the bank.”

One of Hong Kong’s three currency-issuing banks, HSBC generates the bulk of its pre-tax profit from its Asian business.