Advertisement

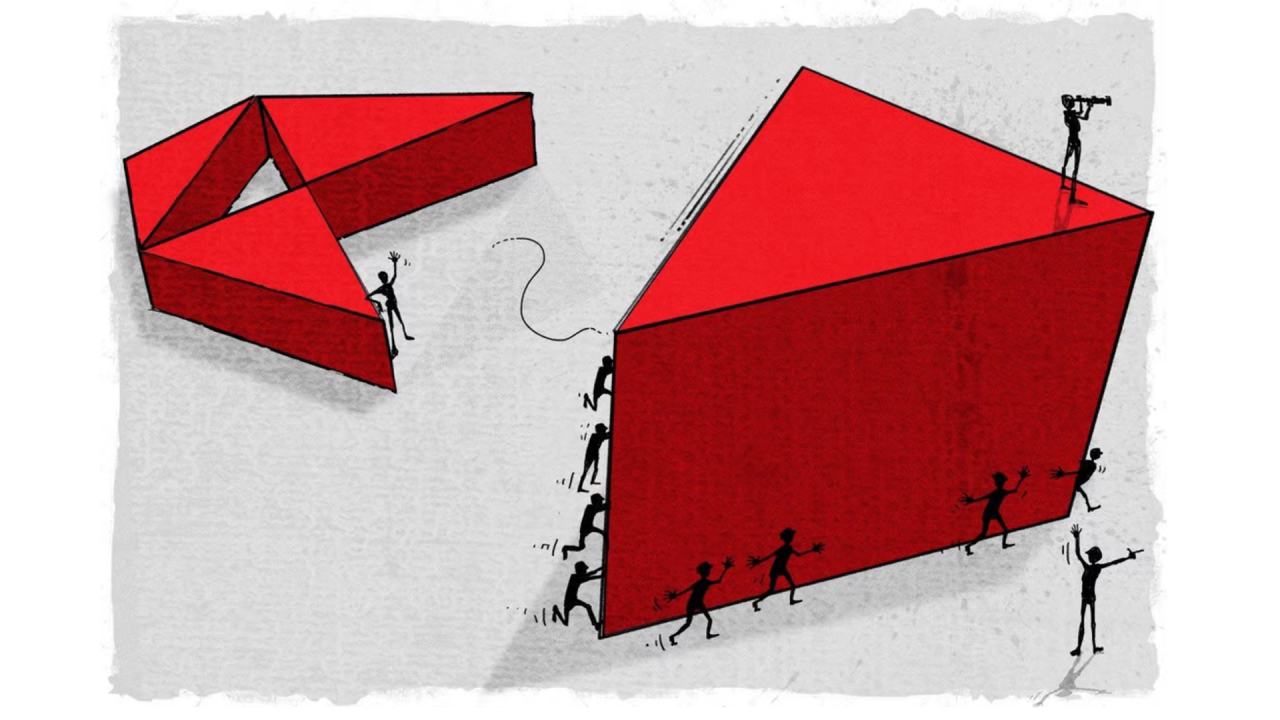

Ping An continues war of words with HSBC over proposed Asian arm listing

- China’s biggest insurer said its proposal to list HSBC’s Asian operations in Hong Kong would not result in value destruction, higher costs

- Ping An has been pushing for HSBC to make structural changes to increase shareholder value

Reading Time:3 minutes

Why you can trust SCMP

4

Chad Brayin London

Ping An Insurance Group hit back at HSBC again on Friday in the latest tit-for-tat between the companies over its push to separately list the bank’s Asian operations in Hong Kong.

Advertisement

The asset management arm of China’s biggest insurer called for HSBC earlier this week to sell a minority stake in the bank’s Asian arm through a listing on the Hong Kong stock exchange, with HSBC remaining the unit’s majority owner similar to the lender’s 62.14 per cent ownership of Hang Seng Bank.

On Friday, Michael Huang, Ping An Asset Management’s chairman and CEO, denied that its latest proposal was a “spin off” of HSBC’s Asian operations and said it should not result in the “exaggerated global value destruction, surging operating costs and legal barriers as portrayed by HSBC”.

“Up to now, HSBC has not engaged in any deep discussions with Ping An regarding the new strategic restructuring proposal,” he said in a statement. “As in accordance with the fundamental principles of global corporate governance principles, HSBC should at least respect their shareholders and their concerns or views.”

HSBC declined to comment on Friday, referring journalists to its statement earlier this week pushing back against Ping An’s claims on the benefits of its proposal.

Advertisement

Advertisement