Advertisement

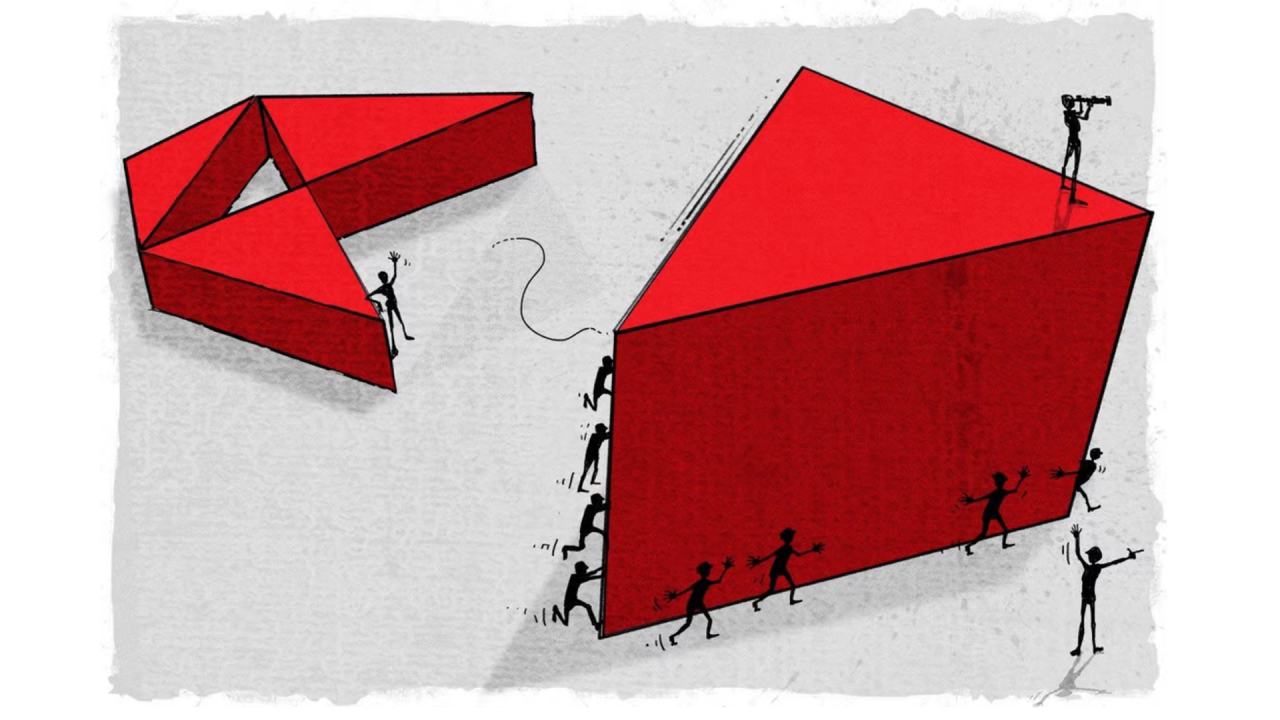

Ping An calls for HSBC to separately list Asian arm in Hong Kong as it continues to push for restructuring

- HSBC’s biggest shareholder calls for the bank to remain a majority shareholder of a separately-listed Asia business

- Ping An has been calling in the past year for HSBC to consider changes to enhance shareholder value, such as a spin-off of its Asian operations

Reading Time:3 minutes

Why you can trust SCMP

Chad Brayin London

Ping An Insurance Group, HSBC’s biggest shareholder, has called for HSBC to separately list its Asian arm in Hong Kong as it continues to push the London-based lender to make structural changes to enhance its value.

Advertisement

On Tuesday, the insurer’s asset management arm – which holds its HSBC investment – said it favours a separate listing of the Asian business with HSBC remaining as the majority shareholder, similar to its 62.14 per cent ownership of Hang Seng Bank.

“We believe the new HSBC Asia, after strategic restructuring, will rapidly become one of the most profitable businesses with a dedicated Asia focused management team capable of generating stronger shareholder returns,’’ Michael Huang, the Ping An Asset Management CEO, said in a statement.

“It will be the most valuable and unique bank in Asia with the strongest growth potential within the HSBC system, and also the only local bank with global competitiveness.”

Ping An, the largest insurer in China, has pushed HSBC since just before last year’s annual meeting to be more aggressive in its cost-cutting and consider structural changes to enhance shareholder value, including a spin-off of its Asian operations.

Advertisement

Advertisement