Mao’s former barefoot doctor recalls sole foreign takeover of Chinese bank

- Opportunity to buy control of a bank in China, home to the fast economic growth in the world, was certainly appealing, Shan Weijian says in new book Money Machine

- Jiang Zemin and his government considered foreign investment and participation ‘as critical to their reforms and growth agenda’

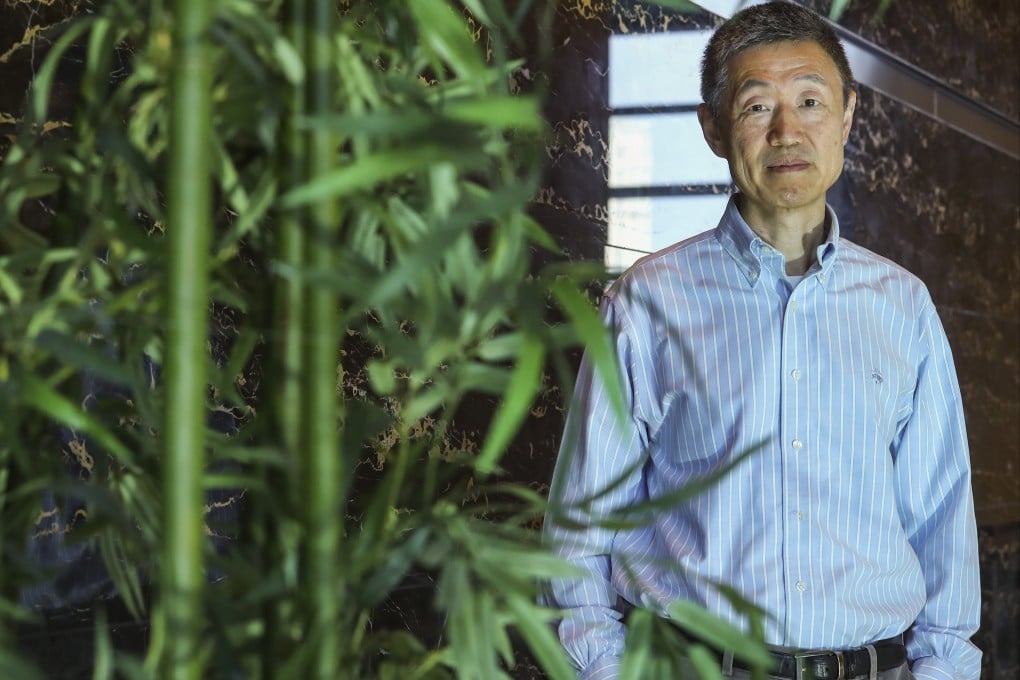

Shan Weijian recalled China’s golden era of economic reforms from 2000 to 2010, and the eye-watering growth evident in this period.

In 2005, he led the only foreign takeover of a Chinese bank to date, and had to navigate the twists and turns of a country that was eager to change, but only wanted foreign capital that would come in on friendly terms.

Shan was the co-managing partner of San Francisco-based private-equity firm Newbridge Capital when it took over a controlling stake in Shenzhen Development Bank. It acquired non-tradeable shares held by various government units that amounted to an 18 per cent stake in the lender.

“I could not deny it: the opportunity to buy control of a bank in China, home to the fast economic growth in the world, was certainly appealing,” Shan, who has also worked with JPMorgan in Hong Kong, said in his new book, Money Machine: A Trailblazing American Venture in China, recalling his excitement at being approached by the Chinese bank.

That was in April 2002, a few months after China joined the World Trade Organization in December 2001 and started actively playing a role on the international stage. Its economy would grow more than six times to US$6.1 trillion between 2000 and 2010.