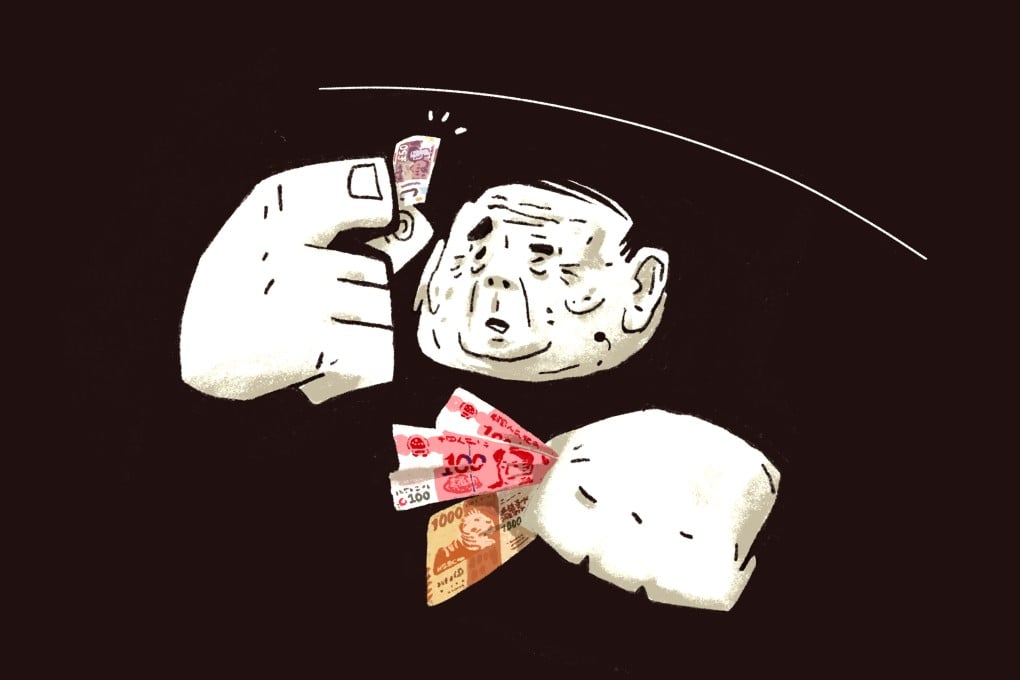

Currency anxiety: Chinese, Hong Kong businesses sweat fallout from the diminished UK pound

- Biggest Chinese, Hong Kong businesses in Britain generated more than £63 billion (US$71 billion) in revenue last year

- Wild swings in currency could lessen buying power, erase investment value and make financing more expensive as Bank of England eyes more rate increases

The pound’s wild swings – it fell to a 50-year low against the US dollar at one point in recent weeks before recovering somewhat this week– threaten more than £63 billion (US$71 billion) in revenue and tens of billions of dollars in investments for these companies, according to analysts.

Fluctuations in the pound could also endanger the value of at least £93 billion in foreign direct investment pumped into the British economy by Hong Kong and Chinese companies in recent years and more than £1.14 billion in properties bought this year.

Companies without currency hedges will have to work harder to pay off loans while making a smaller profit if the pound remains challenged, said Ian Zhu, managing director of the start-up consultancy Tou Ying Limited.

“The weaker pound will lead to reduced buying power of importing from China, which leads to higher inflation as well,” Zhu said. “It will not just impact Chinese companies in the UK, but also impact all British companies importing from overseas where the US dollar is the trading currency.”