Silver Bonds: Hong Kong gets HK$62.6 billion of bids from record number of subscribers seeking inflation-beating returns

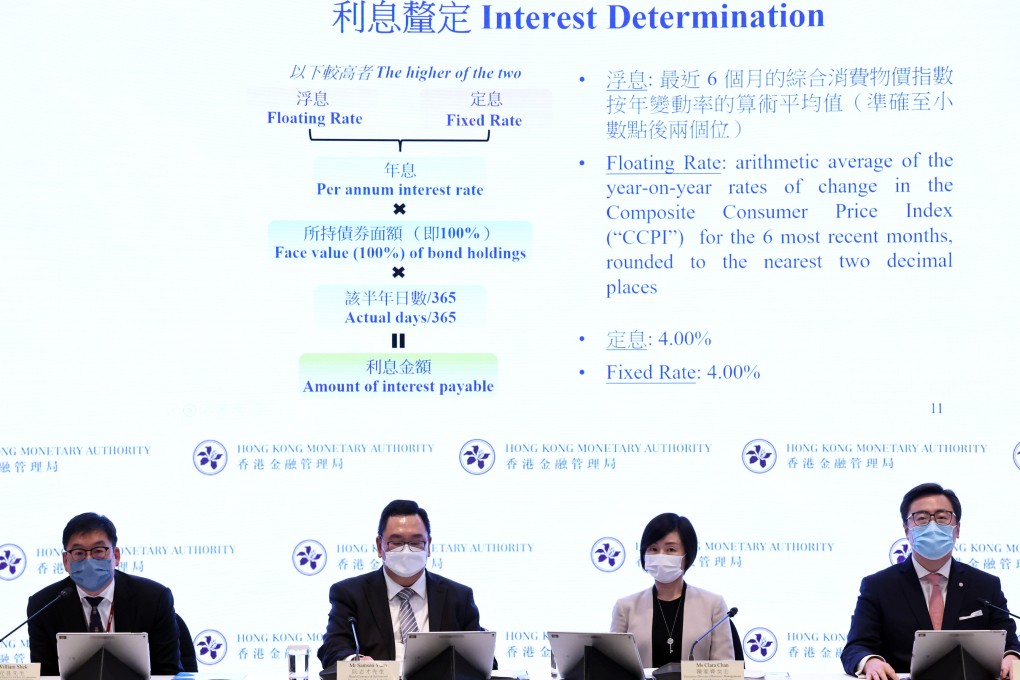

- The HK$45 billion inflation-protected bonds guarantee at least a 4 per cent annual coupon, a variable target pegged to the city’s inflation rate

- Consumer prices rose 1.9 per cent in July, the most this year; it is the biggest jump since May 2020, if subsidies and one-off relief measures are removed

The treasury received HK$62.64 billion of bids for the HK$35 billion of three-year notes known as Silver Bonds on offer, a government spokesperson said on Friday. It boosted the offering size to HK$45 billion to meet the excess demand.

The bids came from 290,000 subscribers, 13 per cent more than last year when 257,000 senior citizens lodged a record HK$67.9 billion of bids for HK$30 billion of notes on sale. The number of applications and the final issue size are the highest since the government began selling the securities in 2016.

The latest batch of Silver Bonds will pay a guaranteed interest rate of at least 4 per cent annually, a variable target pegged to the city’s inflation rate. It is a step up from the 3.5 per cent rate in the 2021 series, and compares favourably with a one-year time deposit rate of 2 to 3 per cent offered by local commercial banks.