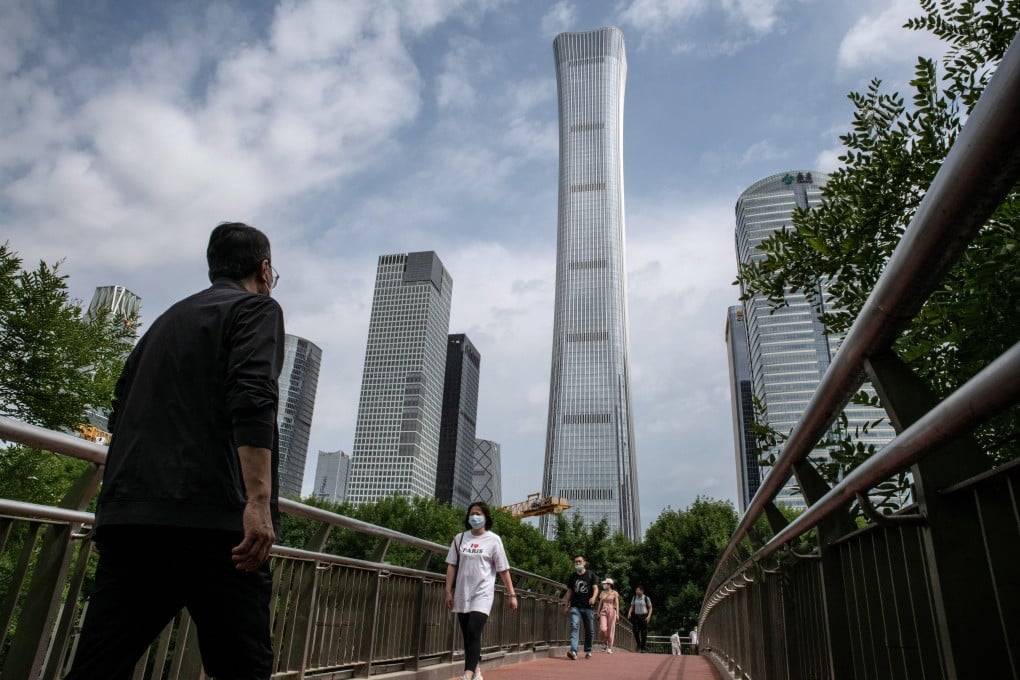

Family offices’ investments in China expected to cool down amid regulatory crackdown, real estate stress, UBS survey finds

- Only 39 per cent of global family offices expect to raise their asset allocations into China over the next five years, compared with 61 per cent in 2021, UBS survey shows

- Family offices from Asia-Pacific show a bias towards region as they allocate 40 per cent of their portfolios to Greater China while western Europe and US investors set aside 5 per cent

Family offices are cautious about China’s growth and remain wary of committing more investments to the country as a survey from UBS showed a heightened reluctance from such clients to increase their allocations in the mainland.

“It appears that the country’s regulatory measures and signs of stress in the real estate sector have blunted last year’s high levels of enthusiasm,” UBS said in the report, which surveyed 221 single family offices with a total net worth of US$493 billion between 19 January and 20 February this year.

China’s sweeping regulatory crackdown on the country’s tech sector, launched 20 months ago, has wiped out trillions of dollars in market value across New York and Hong Kong, while deterring venture funding for Chinese tech start-ups. Meanwhile, a number of mainland property developers are facing a liquidity crisis and have been pushed to the brink of default.