Oil ETFs are on a roll as energy crunch helps exchange traded funds outshine all other investments

- Mirae’s Global X S&P Crude Oil Futures ETF returned investors 48.6 per cent this year while the Samsung S&P GSCI Crude Oil Futures ETF returned 52 per cent

- The two oil funds were the top performers out of 100 funds traded in Hong Kong, according to Morningstar

Exchange-traded funds (ETFs) that track crude oil futures have been the top performers this year compared to other financial instruments, most of them returning over 40 per cent since January, as a supply crunch kept spot prices ahead of futures.

Investors have sold and took profit on the two crude oil ETFs in Hong Kong and four in mainland China with US$430 million in combined assets, riding on this year’s rebound in oil prices that reached seven-year highs several times.

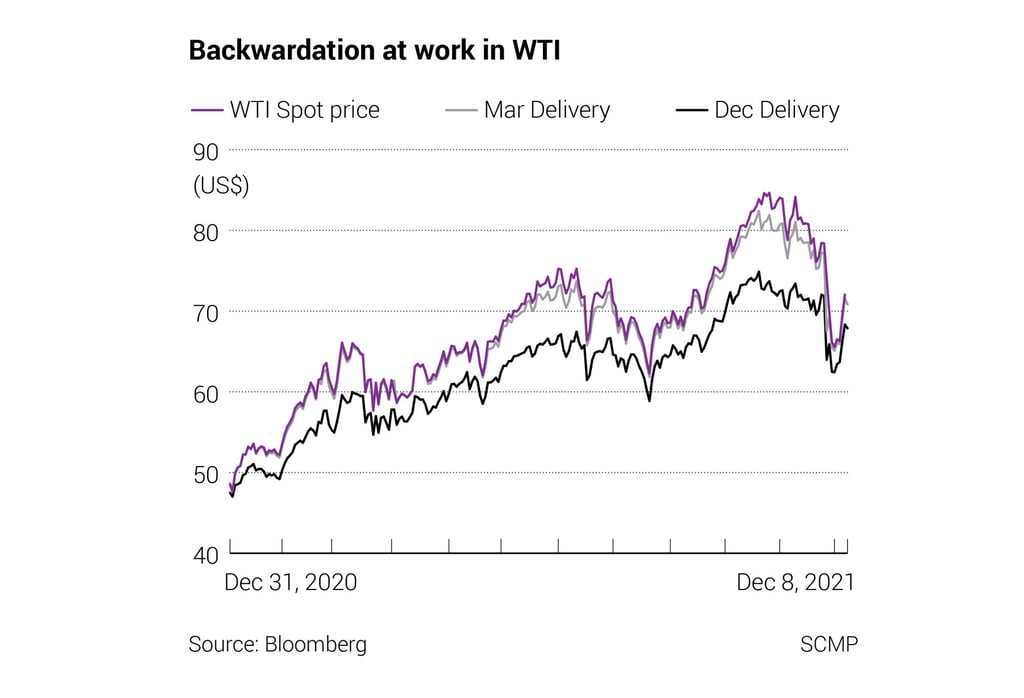

ETF managers gained handsomely this year from backwardation, the market condition where oil futures trade below the expected spot price in a downwards sloping futures curve. They would roll their futures exposure forward, pocketing the spread as returns for their funds. Unlike stocks, futures contracts expire, requiring them to be rolled over to keep the fund running.

Spot crude oil prices have risen 44 per cent this year to US$69.49 per barrel in Cushing, Oklahoma, boosted by a sharp uptick in global demand as the world economy recovers from the Covid-19 pandemic. West Texas Intermediate (WTI) futures for December delivery rose 75 per cent for the year to October to US$83.42 a barrel, the highest since 2014.

Some analysts expect oil prices to go even higher. JPMorgan raised its 2022 oil price forecast in late November to US$125 per barrel and US$150 per barrel in 2023. The spread of the new Covid-19 variant Omicron in late November has halted the recent gains in oil prices.