Advertisement

Hong Kong to review rules on whether to allow retail investors trade cryptocurrency ETFs, regulator says

- The SFC is reviewing cryptocurrency regulation as the virtual assets have developed as mainstream financial investment worldwide

- The value of bitcoin, the largest cryptocurrency, jumped sixfold to US$63,238 this week from 2018

Reading Time:2 minutes

Why you can trust SCMP

Hong Kong’s financial regulator is reviewing the rules governing transactions of cryptocurrencies, including whether individual retail investors are allowed to dabble in exchange traded funds (ETFs) with exposure to virtual assets.

Advertisement

The Securities and Futures Commission (SFC) said it would review the 2018 rules that limited transactions of cryptocurrencies via funds or trading platforms to professional investors with at least HK$8 million to invest “to see if it is still fit for purpose, and whether modifications are required,” said its deputy chief executive Julia Leung Fung-yee.

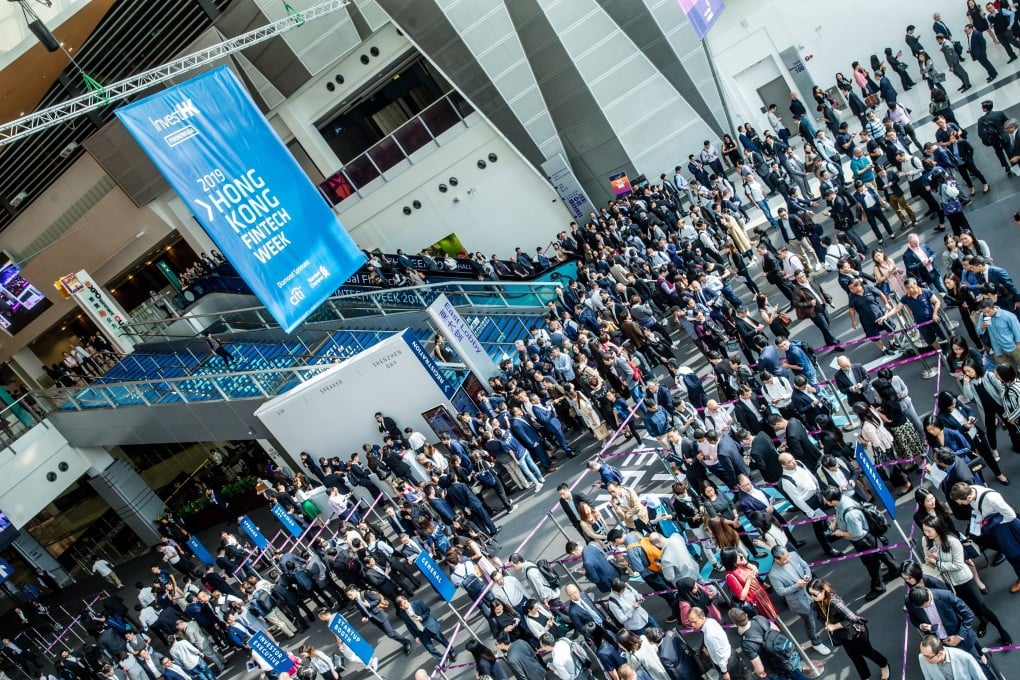

The review is being conducted because “virtual assets are edging towards mainstream finance,” Leung said at a seminar during the 2021 Hong Kong FinTech Week. “More, [and] different types of virtual asset investment products are available and conventional exchanges overseas now offer cryptocurrency ETFs.”

Cryptocurrency ETFs don’t trade in Hong Kong, although these financial products are available overseas. The US Securities and Exchange Commission (SEC) has received at least 12 applications this year to launch these funds to allow speculators to dabble in cryptocurrencies, and the Hong Kong SFC has received a number of inquiries to offer these funds to private bank clients and professional investors.

Advertisement

Cryptocurrencies and tokens have surged in popularity in the three years since the SFC introduced its rules, with the value of bitcoin soaring sixfold since 2018 to US$62,238 this week.

Advertisement