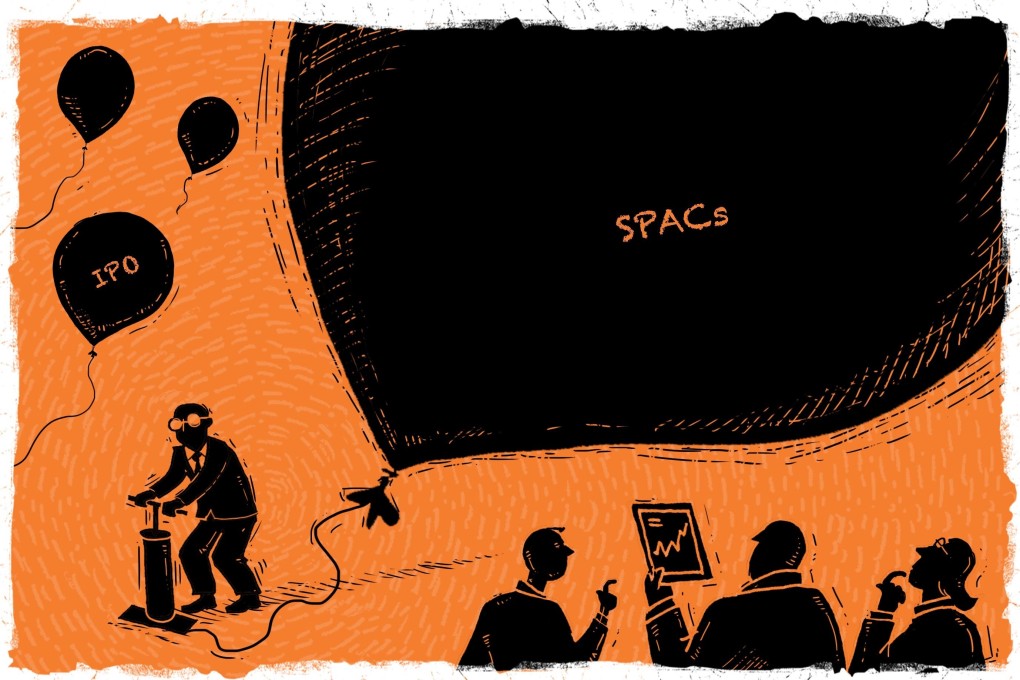

Has Asia missed the blank-cheque boat? The SPACs frenzy is cooling before Hong Kong, Singapore even get off the starting blocks

- SPAC fundraising in April slowed to its lowest level in nearly a year after eye-popping capital raising in the first quarter raised US regulators’ concerns

- Appetite for SPACs remains high among Asian investors, target companies despite fundraising pause, advisers, sponsors say

Singapore expects to open its arms to SPACs by midyear, and excited deal advisers are fielding enquiries from hoards of Asian companies looking for a faster and easier way to raise capital from investors in the public market.

That momentum may come to a grinding halt after SPAC fundraising slowed to just US$3.6 billion in April, the lowest amount in a month since June last year, according to financial data provider Refinitiv.

Calls for a watered-down SPAC framework from traditionally risk-averse regulators in Hong Kong and Singapore are gaining a wider audience. The conservative camp is keen to enact rules that weed out the weakest companies seeking a public listing and offer greater protection to retail investors.

03:34

SPACs: Everything you need to know about the finance world’s new big thing

The declining IPOs of SPACs, particularly in the United States, may be the sign that Asian markets have missed the boat with the latest and hottest buzzword in global finance. Blank-cheque companies, as SPACs are also known, have already raised nearly US$100 billion globally in the first three months of the year, with the vast majority of listings on American bourses.

“Companies from Hong Kong, Asia and China were two years behind the US [in terms of SPACs]. It was not until last year they showed interest,” Jason Wong, a SPAC sponsor and partner at Whiz Partners Asia, the Asian affiliate of Japan’s Whiz Partners. “The trend will continue.”