US private equity firm Platinum closes in on its US$7 billion takeover for HNA Group’s stake in Ingram Micro, sources say

- Platinum and Chinese conglomerate HNA are hammering out the final details of a transaction that could be announced as soon as this week, according to people familiar with the matter

- Platinum has already lined up financing for the acquisition of Irvine, California-based Ingram Micro, they said

US private equity firm Platinum Equity is nearing an agreement to buy HNA Group’s Ingram Micro in a deal that values the technology provider at about US$7 billion, including debt, according to people with knowledge of the matter.

Platinum and Chinese conglomerate HNA are hammering out the final details of a transaction that could be announced as soon as this week, the people said, asking not to be identified because the matter is private. Platinum has already lined up financing for the acquisition of Irvine, California-based Ingram Micro, the people said.

Talks are ongoing and either party could decide not to proceed with the sale, the people said. A representative for HNA declined to comment, while a representative for Platinum did not immediately respond to requests for comment.

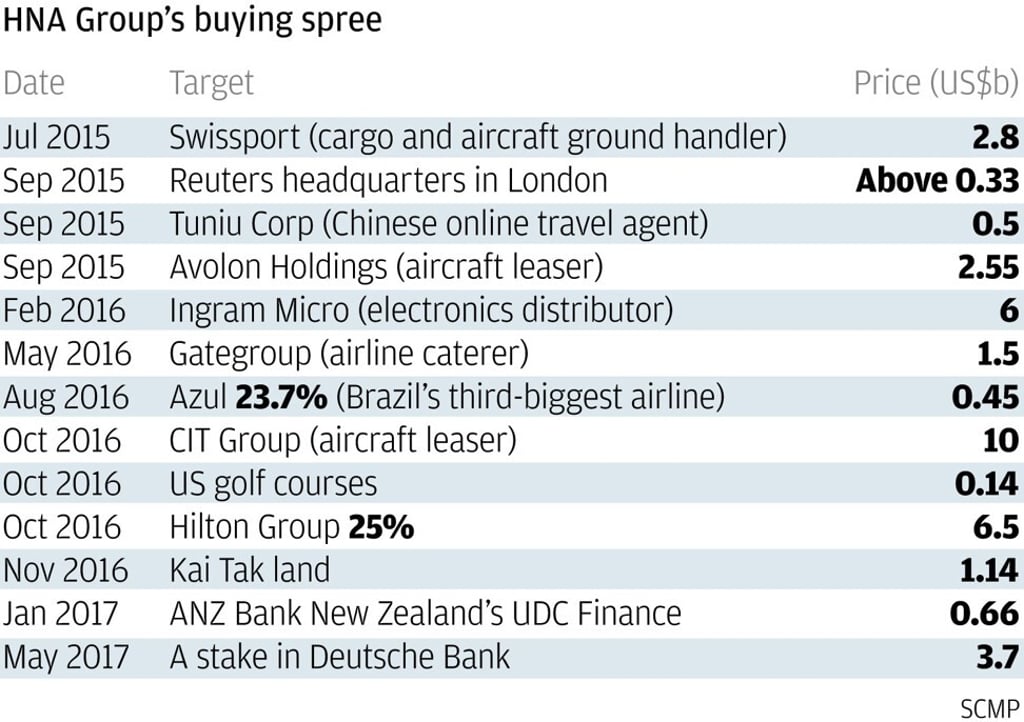

A transaction would cap months of negotiations between the buyout fund and the Chinese conglomerate, which Bloomberg News first reported in August.

At US$7 billion, the sale would be the biggest asset disposal by a Chinese company to a buyer outside the country in the year to date, according to data compiled by Bloomberg.