Record low rates are here to stay regardless who sits in the Oval Office. Will that keep markets pumping in the age of Covid-19?

- A short-term pullback in stocks is possible despite historically low interest rates as investors digest the US election, analysts said

- Central bankers unlikely to tap the brakes until there is a sign of a more persistent economic recovery globally

After American voters made their preferences known at the ballot box, the world’s focus returns to the role of the United States Federal Reserve’s monetary policy during the coronavirus pandemic. The latest part of our US election series looks at the impact. Read other stories in the series here.

The uneven global recovery has investment strategists and economists split on whether financial markets are ripe for a pullback, particularly as investors try to digest the outcome of the US elections this week.

One thing is clear: central bankers are unlikely to apply the brakes until there are signs of a more persistent recovery. Some monetary policymakers may even pursue more controversial policy measures, including negative interest rates, if further fiscal stimulus by governments remains elusive.

03:05

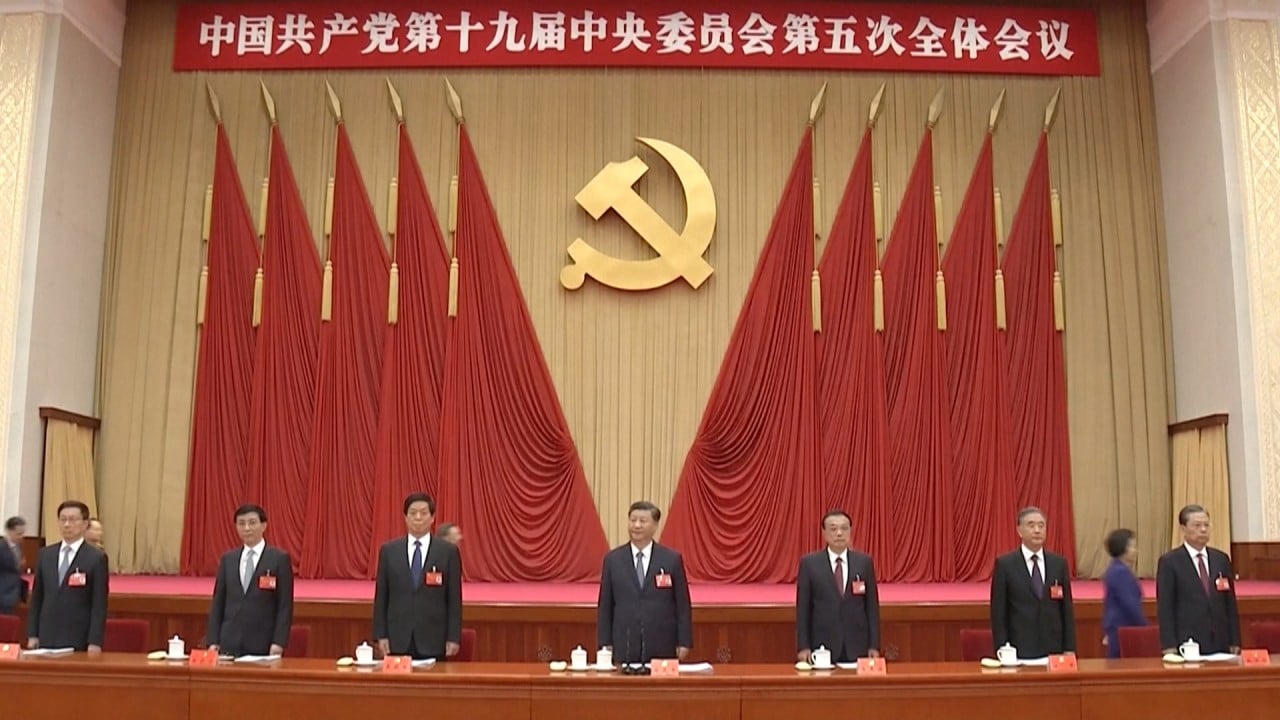

What happened at the Chinese Communist Party’s major policy meeting, the fifth plenum?

Heading into the US elections, Axi’s chief global market strategist Stephen Innes said he had never seen such a “broad based disparity” in market forecasts.